1-What is Dividend Growth Investing?

What is Dividend Growth Investing?

Dividend Growth Investing (DGI) is a long-term, buy-and-hold investment strategy—typically held for 5 years or more—that focuses on building a growing stream of income over time.

Think of it like planting a tree. Once planted, the tree steadily grows, producing more fruit each year. Even if the tree stops growing taller, the fruit it produces—your dividends—keeps increasing. Let’s break that down.

What are Dividends?

Dividends are payments made by a company to its shareholders. They represent a form of passive income—often called dividend income. For example:

- You invest $1,000 to buy 100 shares in a company with a 4% dividend yield.

- This means the company pays $0.40 per share, giving you $40 in dividend income each year.

Now, add Growth to the mix:

Dividend Growth Investing means that these dividend payments increase year after year. Let’s say next year the company raises its dividend to $0.45 per share. Your 100 shares now bring in $45 in dividends—an extra $5 just for holding the stock.

That’s a 12.5% raise in your income, just for staying invested! Imagine this happening every year: your income could grow from $40 to $45, then $50.63, and so on, assuming the dividend increases by 12.5% annually.

Find Out which of the Hong Kong Stocks Have Dividend Growth Potential—Skip Hours of Research |

This growing stream of income is like harvesting more fruit from the same tree.

What about the stock price?

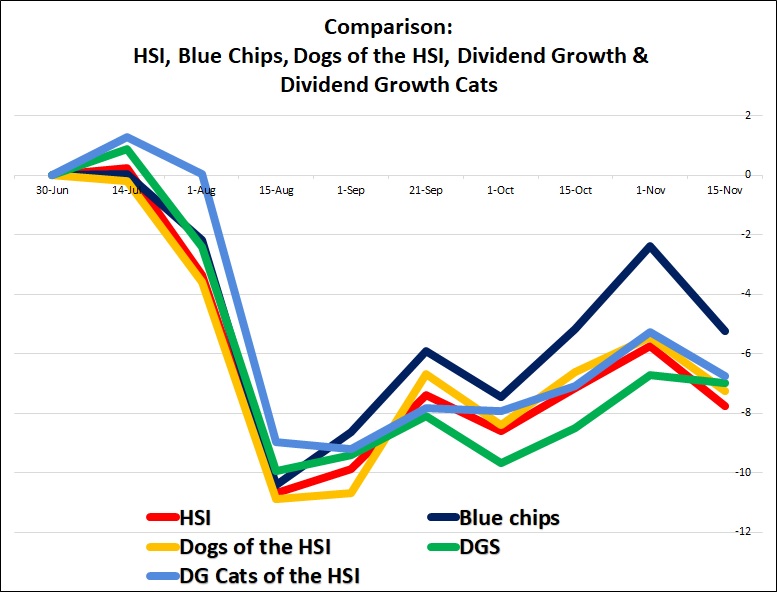

While dividend growth is key, the value of your initial investment can also increase. Companies that consistently raise dividends tend to grow in value steadily over time and often recover faster after market downturns.

Think of it like this: as long as the goose keeps laying golden eggs (dividends), you don’t have to worry much about whether the goose is gaining or losing weight (the stock price). Of course, if the company’s financial health declines, it may cut dividends, so keeping an eye on its performance is essential.

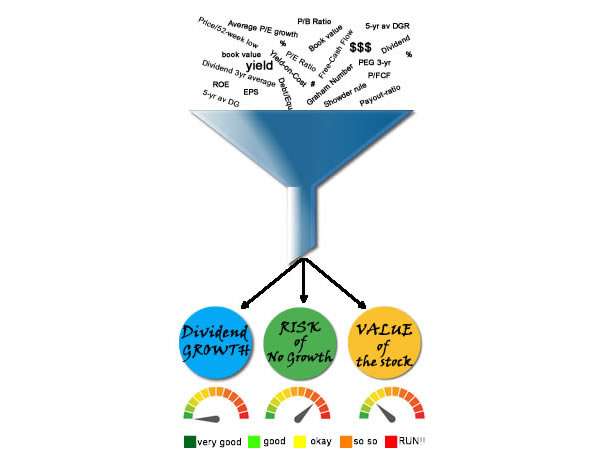

In summary: Dividend Growth Investing is about building a steady, growing source of passive income. The key is to identify and invest in companies with a strong track record of increasing dividends and a bright future ahead.

What to Look for When Choosing Dividend Growth Stocks (Part I)

Next: What to look for while you are selecting your next Dividend Growth Investment move Part I

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.