10 Key questions about P/E Ratio

10 Key questions about P/E Ratio

1. What is a good P/E ratio?

A P/E ratio of 20 or lower is generally considered good, as it suggests the stock is fairly valued relative to earnings. However, what’s “good” depends on the industry—some sectors naturally have higher P/E ratios due to growth expectations.

2. Is a high or low P/E ratio better?

Neither is automatically better. A low P/E may indicate undervaluation or financial trouble, while a high P/E could mean strong growth potential or overvaluation. Always compare a stock’s P/E to its industry average and historical levels.

3. Does Warren Buffett use the P/E ratio?

Yes, but as just one of many valuation tools. Buffett prefers to look at earnings quality, long-term business performance, and intrinsic value, rather than relying solely on P/E.

4. Is a negative P/E ratio good?

No, a negative P/E means the company is losing money, as it has negative earnings. This is a red flag, especially for dividend investors, because a company that isn’t profitable may struggle to sustain payouts.

5. How do you analyze a P/E ratio?

Start by comparing it to:

- The company’s historical P/E (Is it higher or lower than usual?)

- The industry average P/E (Is it in line with competitors?)

- The growth rate (Is the company expected to grow earnings fast enough to justify its P/E?)

6. What is the difference between trailing and forward P/E?

- Trailing P/E uses past 12 months’ earnings (real data, but backward-looking).

- Forward P/E uses projected earnings (useful but based on estimates).

A big gap between them can signal expected growth or overly optimistic forecasts.

7. Can a stock have no P/E ratio?

Yes. A stock with zero or no P/E usually means the company has no earnings or is reporting losses, making it ineligible for a meaningful P/E calculation.

8. Is a P/E of 30 too high?

It depends. A P/E of 30 is high for a mature dividend stock but normal for a high-growth company. The key is earnings growth—if a company can grow into its valuation, a high P/E may be justified.

9. Why do some great dividend stocks have low P/E ratios?

Many strong dividend stocks have steady but slow earnings growth, leading to lower P/E ratios. Investors often prioritize yield and stability over high earnings expansion, keeping valuations reasonable.

10. Should you rely only on P/E when choosing stocks?

No. P/E is just a first glance at valuation. Always check earnings growth, debt levels, dividend safety, and industry trends to get the full picture.

Did you like this? Here’s more :

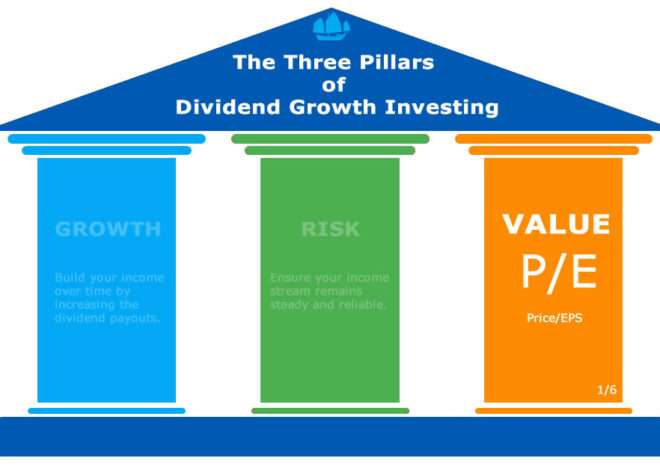

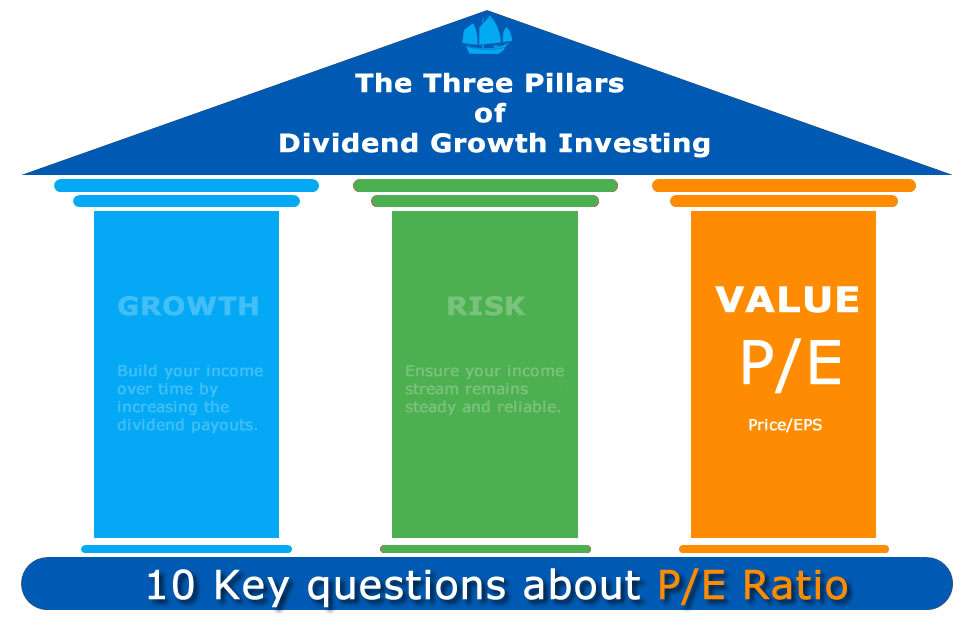

Where does P/E ratio stand in the 3 pillars of dividend growth investing?

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.