10 reasons why Hong Kong dividend stocks are awesome

10 reasons why Hong Kong dividend stocks are awesome.

When it comes to dividend growth investing, US stocks seem the popular choice, but did you know that there are other options available as well? For instance, many European companies offer strong dividend growth potential, such as Nestle and Unilever. In addition, the Hong Kong stock market has also seen significant growth in recent years and offers a range of companies with strong dividends.

By diversifying your portfolio to include these options, you can potentially increase your dividend income and reduce your overall investment risk. It’s worth considering all the possibilities and exploring different markets to find the best investment opportunities for your unique financial goals. Here are the top 10 reasons why Hong Kong dividend stocks are awesome.

-

- Undervalued stocks. Hong Kong stocks are relatively undervalued compared to stocks in other developed markets. This means that investors can potentially get higher yields by investing in Hong Kong dividend stocks.

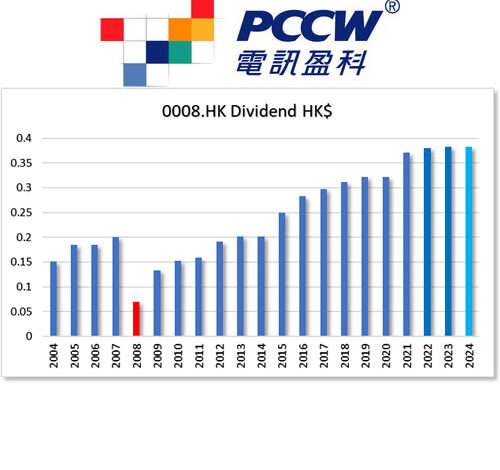

- History of paying dividends. Many Hong Kong companies have a history of paying dividends, which is a good sign that they are financially sound and committed to shareholder value.

- Low corporate tax rate. The corporate tax rate in Hong Kong is relatively low, which means that companies can afford to pay out higher dividends.

- Major financial center. Hong Kong is a major financial center, which means that it has a well-developed stock market and a deep pool of liquidity. This makes it easy for investors to buy and sell Hong Kong dividend stocks.

- Accessible to international investors. Hong Kong stocks are accessible to international investors, which means that investors from all over the world can participate in the market.

- High dividend yield. The average dividend yield for Hong Kong stocks is generally higher than the average dividend yields of stocks in developed countries such as the United States and the United Kingdom. This means that investors can potentially earn a higher income by investing in Hong Kong dividend stocks.

- Less volatile than other stocks. Hong Kong stocks are generally less volatile than stocks in other developed markets. This means that they are less risky, which is important for investors who are looking for a steady income stream.

- Good diversification benefits. Investing in Hong Kong dividend stocks can help to diversify a portfolio and reduce risk. This is because Hong Kong stocks are not correlated with stocks in other developed markets.

- Good way to get exposure to the Chinese economy. Hong Kong is a gateway to the Chinese economy, which is the second largest economy in the world. Investing in Hong Kong dividend stocks can be a good way to get exposure to this growing market.

- The Hong Kong Dollar has been pegged to the US Dollar. This means that the value of the Hong Kong Dollar is kept within a narrow band against the US Dollar, and any changes in the value of the US Dollar are mirrored in the value of the Hong Kong Dollar. The peg was put in place to stabilize the Hong Kong economy and to maintain investor confidence in the territory’s financial system.

These are the top 10 reasons why Hong Kong dividend stocks are awesome. However, it is important to do your own research before investing in any stock, including Hong Kong dividend stocks.

Here are some additional things to consider when investing in Hong Kong dividend stocks:

- The specific company’s financial health and dividend payment history.

- The overall economic outlook for Hong Kong and the global economy.

- Your own investment goals and risk tolerance.

If you are considering investing in Hong Kong dividend stocks, it is recommend that you speak with a financial advisor to get personalized advice.

Find Out which of the Hong Kong Stocks Have Dividend Growth Potential—Skip Hours of Research |

And if you are wondering if dividend growth strategy is a fit for you, this post can be recommended:

10 Reasons why dividend growth investing is awesome

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.