210724 Update Hong Kong Dividend Growth stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

Hello everybody,

Your quick update on the Hong Kong Dividend stocks and your new Free updated 25 highest yield dividend growth stocks. (Scroll down and hit the blue button)

Saturday, and I hope you had a marvelous week and you are enjoying a great weekend too.

Reading time of this email: 1 minute.

– What happened last week?

– What to look out for next week?

– The 25 highest yield dividend growth stocks, what stands out?

– Hong Kong Dividend Growth Stocks averages on July 23, 2021:

– In case you missed this:

– What happened last week?

In the Blue Chip world, Sands China LTD. HKG:1928 gave a positive note to the second quarter. This casino is making money again! That is a good sign.

– What to look out for next week?

Upcoming week will be filled with the announcements of:

Hang Lung Group HKG:0010 Interim results. Hang Lung Properties HKG:0101 Interim results. Both ended not so well last year. They kept dividends up. It will be exciting to see what the results are. Sleepless night ahead here!

International Housewares Retail Co. Ltd HKG:1373 Year Ending April 30, 2021. Expectations are high on this one. Interim results were beyond imagination and the increase of interim dividend only was over 35%.

-The 25 highest yield dividend growth stocks, what stands out?

If you download the freshly updated list (blue button) you will see Puxing Energy HKG:0090 in green. There is fascination about the rise in dividend over 2020. Even more the P/E ratio is 2.9, which is just adorable! The metric that hold it all a bit back it that there are only 6 consecutive years of dividend increase. That is promising, but will it prove a steady course?

Hong Kong Dividend Growth Stocks averages on July 16, 2021:

Of all Hong Kong Dividend Growth stocks, the averages are:

- The average yield of all companies in the Directory is 4.80% .

- Of all these stocks the average 5-year-average-dividend-growth is 21.58%

- 1-year-average Dividend growth is 13.50

- When we do: yield 4.71% x growth 21.58% => 10%-Yield-on-Cost will be in 5 years.

- Average Price-to-Earnings ratio (P/E) is: 14.53

- Average Earnings per Share (EPS) is: 1.168

If you have any questions, recommendations, bright ideas, be sure to let me know. Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

Great links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

- Upcoming Ex-Dividend dates this week

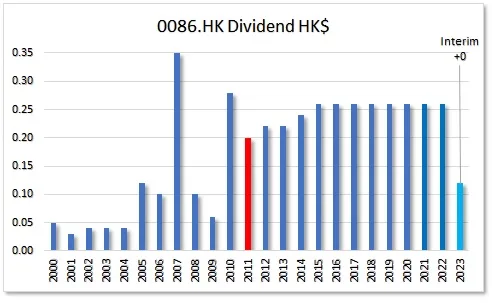

- Watch some Beautiful Dividend Charts

Stocks that go Ex Dividend are featured on

Instagram, Twitter and Facebook.

Click and keep in touch easily with HKDS!

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.