220123 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

Hello,

How was your week?

Re: We look at all Hong Kong Dividend Growth stocks and Blue Chips.

Dividend stocks should have:

- 5 years or more of dividend increases. Stocks that give you a raise!

- 5 yr dividend growth rate of 0.001 or higher.

Reading time of this email: 2 minutes.

– Talking about the Hong Kong Blue Chip Companies.

– The 25 highest yield dividend growth stocks, what stands out?

– and Dividend Growth Stocks from the Directory, what stands out?

– The stock screeners favorite this week

– Hong Kong Dividend Growth Stocks averages on January 21, 2022:

– Great links you can not miss out on

If you are planning on investing in yourself and in building the best possible portfolio that generates dividend income and growth in total value, the Champion Membership can get you on your way. Data, for Discovering hidden treasures and making calculated Decisions.

Did you read last week’s newsletter? Oh missed that one. Here, if you want to catch up.

Talking about the Hong Kong Blue Chip Companies.

In the Blue Chip section we are looking for good companies that come for a good price.

This week Enn Energy HKG:2688 became a little more interesting. Compared to last week price went down 7%.(-10% since January 1)

Their interim dividend was up 100%

This is also one of the 24 Blue Chip companies that are in the dividend growth stock file! So, a solid company that provides increasing dividend income.

If this company sounds familiar, you’re right. In this newsletter we questioned if this really is a Dividend Challenger or a Contender.

Champion Members: There is a ridiculously awesome sheet to be discovered in the Blue Chip Value Insights .xls. The added sheet is named Blue-Chip_Value-Screener.

This is what Enn Energy looks like right now:

What is this?

The Value Screener gives a number and a color to all Blue Clip listings dedicated to see how the value of the stock can be interpreted. (Overvalued, undervalued.)

Red (0-20) = Bad, run!

Orange (25-40) = Not bad enough, but certainly not good

Yellow (45-60) = mid-range, which is starting to be worthwhile to look into

Light green (65-80) = Good

Green (85-100) = Super good, take a dive and find out why this looks so good.

To come to the given number and color we look at 10 different metrics that give an indication for the value-to-price relation of a stock.

In this new sheet, Blue-Chip_Value-Screener, you see how the Value Screener moves per Blue Chip over the course of 2022, week by week.

If you run into any question, just send me an email.

In other Blue Chip news: Anta HKG:2020 came with a positive profit warning:

On a consolidated basis, after taking into account the share of loss of a joint venture, as

compared to 2020 Full Year, profit attributable to equity shareholders of the Company for

2021 Full Year is expected to record an increase of not less than 45% (2020 Full Year:

approximately RMB5.16 billion). Source

On March 22 we will learn more as that is the date of the announcement of the 2021 results and dividends.

And then there is Sands HKG:1928, their price went up almost 20%, Galaxy HKG:0027 went up 10%. This has to do with the Macau casino licensing.

-The 25 highest yield dividend growth stocks and the Directory for Champion members, what stands out?

Something Extra, only this week, a new column is added in the 25 highest yield Hong Kong Dividend Growth stocks: 5 year average Dividend Growth Ratio. Sign up (free) below for the newsletter and immediate download the 25 highest yield Dividend Growth Stocks.

This gives you insight in how the dividend growth averaged over the last 5 years. We use this to predict future dividend income. This metric together with yield we use to figure out how long it takes (in years) to get to 10% yield on costs.

This ratio is not one to make a single decision on. It pays to look to 1-year growth ratio as well as 3-years average dividend growth ratio.

Which DG stock went up the most this week?

Surprise: HKG:1918 Sunac +24% compared to last week. The property sector needed good news. This was last week’s biggest loser.

Which company went down the most this week?

HKG:0222 M Xin Holding lost 10% compared to last week. They lost this year already 22% in price.

The Stock Screener likes CiFi Holdings HKG:0884

- Yield 7%

- EPS 1.19

- P/E 4.6

- Interim growth in EPS (YoY) 12%

- Payout Ratio 34%

- 5-yr average Dividend Growth 23%

Interim 2021 gave a 9% dividend increase. Chances are final results will be brilliant too. CiFi Holdings keeps on raisin their dividends from the moment they got listed in the Hang Seng Index. That is why they are also in the hall of Beautiful Charts.

Champion Members: Lenovo HKG:0992 changed color: their Value indicator moved from yellow to light green this week.

The Stock Screener is an essential part of the Directory of all Hong Kong Dividend Growth stocks.

Essentially this is what we are looking for:

Stocks that have

-as much as possible dividend growth in the future

-against the lowest possible risk of not getting less or no dividends

-with the highest rise in Value of our invested capital.

Hong Kong Dividend Growth Stocks averages on January 21, 2022:

Of all Hong Kong Dividend Growth stocks, the averages are:

- The average yield of all companies in the Directory is 6% .

- Of all these stocks the average 5-year-average-dividend-growth is 21.81%

- 1-year-average Dividend growth is 14.05%

- When we do: yield 6% x growth 21.81% => 10%-Yield-on-Cost will be in 4 years.

- Average Price-to-Earnings ratio (P/E) is: 10.23 ,

- Average Earnings per Share (EPS) is: 1.663

Great links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

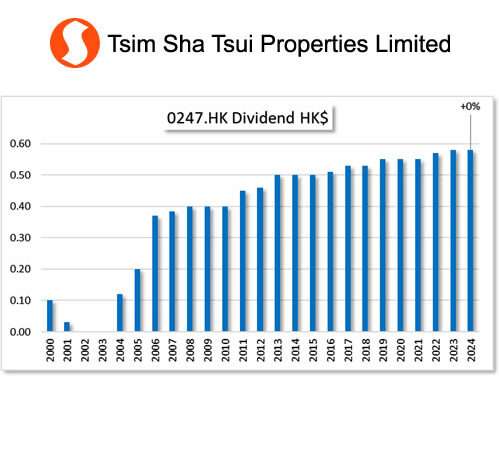

- Watch some Beautiful Dividend Charts

- How to Become a Champion Member? It only takes 5 minutes

- See what happened on Twitter

If you have a question, recommendation, or bright idea, be sure to let me know.

Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

Twitter and Facebook.

Click and keep in touch easily with HKDS!

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.