220619 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

| Happy Sunday!

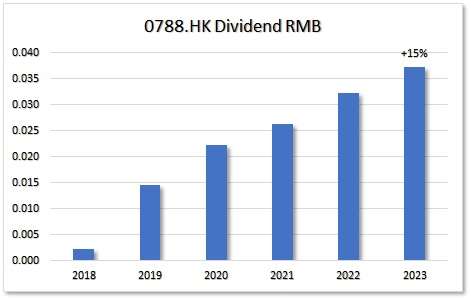

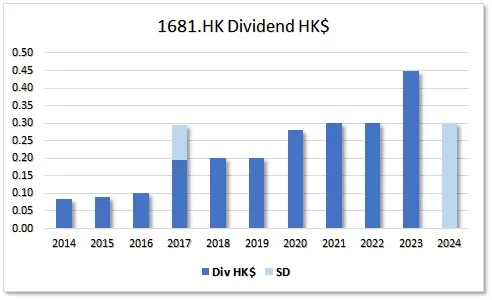

Let’s talk Market turbulence. Last week we saw things are shaking in stock markets and crypto currencies. People lost a lot of money. Here is the good news: What their stock price is going to do, we can not know. But with companies like this one, we can be reasonably confident that they are going to raise their dividends year upon year. And that is the beauty & magic of Dividend Growth investing. Cash flow For some inspiration look at these beautiful charts No.Matter.Wat

Researching stocks that bring you an increasing cash flow is what we do. All these stocks are packed in the Directory. This is an easy to understand overview of all companies that have

So you save a huge amount of time in your research to find the right stocks that are eligible for your cash flow generating portfolio. Warning reading time of this email: 3 minutes. But you will come out smarter! – Last week what stands out? If you have special request for data sets. Just let me know, ASAP. Just send me an email. It would be fun to make customized files. – What stands out. Blue Chips, something exciting to tell: I made a post of the top 5 highest yield Blue Chips. All yield 8% or higher -The 25 highest yield dividend growth stocks In this weeks update of the 25 Dividend Growth Stocks with the highest yield: Download this free file here and see for your self. –Champion Members: HKG:0855 China Water got a lot of greens on the stock screener. Let me know what you see and think. –Hong Kong Dividend Growth Stocks averages on June 17, 2022, Of all Hong Kong Dividend Growth stocks:

Updated links you can not miss out on:

If you have a question, recommendation, or bright idea, be sure to let me know. Just reply to this email. Wishing you a happy day, Petra @ Hong Kong Dividend Stocks |

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.