220731 Update Hong Kong Dividend Growth Stocks

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

This is the newsletter you get if you sign up (FREE). You also get to immediately download the 25 highest yield Dividend Growth Stocks.

Happy Sunday!

We can not predict what the market will do. However, we can investigate which stocks are most likely to pay us dividends at a reliable and increasing pace, year after year.

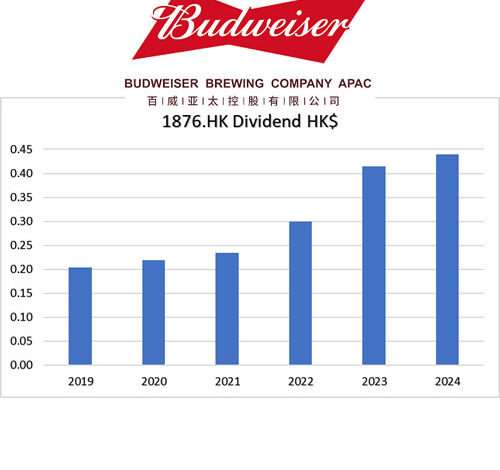

For some inspiration look at these beautiful charts

All Dividend Growth stocks are packed in the Directory. This is an easy to understand overview of all companies that have

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

So you save a huge amount of time in your research to find the right stocks that are eligible for your cash flow generating portfolio.

The Directory is part of the Champion Membership and updated weekly. There is even an easy-to-use stock screener build in, so out of all dividend growth stocks you see in 1 second how they perform on dividend growth, Risk and Value.

Just to make your life easier.

Based on a lot of data we look for good opportunities for Dividend Income creation and Value Investing . (Dividend Growth, Risk of not getting any Dividends and Value for Price)

Reading time of this email: 3 minutes. You will come out wiser

– Last week what stands out?

– The 25 highest yield dividend growth stocks.

– Champion Members: interesting Ex-Dividend coming up

– Hong Kong Dividend Growth Stocks averages on July 29, 2022:

– Great links you can not miss out on

If you have special request for data sets. Just let me know, ASAP. Just send me an email. It would be fun to make customized files.

– What stands out.

IR Retail HKG:1373 came with their numbers. They closed the books on April 30 2022. And although EPS went down 13% compared to the previous year, dividends went up 12%. This did result in a payout ratio of 86%. That is far over the 50% we would like to see.

And then there is the 7% yield. Combine that with 16% average dividend growth over the last 5 years and you might get to 10% Yield on Cost in 2 years!

How does that work?

if you buy for $10, and yield is 7.7%

you get $0.77 dividends.

if the next year dividends grow 16% you receive $0.77 * 1.16 = $ 0.89

Repeat in the second year and you get $0.89 * 1.16 = $1.03

Et voila, there is your 10% Yield on Cost.

This is the hypothesis and in no case investment advice, of course.

-The 25 highest yield dividend growth stocks

are updated. that .xls file you will find on the free members page and the Champion members page.

In this weeks update of the 25 Dividend Growth Stocks with the highest yield:

There is an extra column Lot

What does that tell us? HK stocks are bought per lot, a bunch of shares of the same company. This might save you transaction costs. How many stocks are in a lot tends differs.

In this weeks 25 highest yield dividend growth stocks, you will see the lot size. Lot * price will tell you the initial investment. And lot * dividend give you an estimation of future income.

This is in contrast to US stocks where you can buy fractional shares.

–Champion Members: in a previous newsletter we saw that Lenovo HKG:0992 become a Hong Kong Blue Chip company. That was good news.

Here’s what else is good:

- They raised the dividend compared to the previous book year with 24%

- P/E = 6

- Dividend Payout Ratio 27%

- Return on Equity = 40

- Ex-Dividend : August 1 ( that is tomorrow!!) HK$ 0.30 per share. Stock price at Friday was HK$ 7.59. This final dividend payout makes it already close to 4% yield.

- All 3 parts of the stocks screener (Growth, Risk and Value) are in the green.

Let me know what you see and think.

Also, coming weeks we can expect the interim results of a few Dividend Growth companies that we follow. It is good to see how they are doing sofar in 2022 and let’s hope for increased dividends.

–Hong Kong Dividend Growth Stocks averages on July 29, 2022,

Of all Hong Kong Dividend Growth stocks:

- The average yield of all companies in the Directory is almost 5.7% .

- Of all these stocks the average 5-year-average-dividend-growth is 20%

- 1-year-average Dividend growth is 16.6%

- When we do: yield 5.4% x growth 20% => 10%-Yield-on-Cost will be in 6 years.

- Average Price-to-Earnings ratio (P/E) is: 10

Updated links you can not miss out on:

- The latest top 10 Highest yield Dividend Growth stocks

- Download 25-Highest-yield Dividend Growth Stocks

- Upcoming Ex-Dividend dates this month

- Watch some Beautiful Dividend Charts

- How to Become a Champion Member

If you have a question, recommendation, or bright idea, be sure to let me know. Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

Facebook.

Click and keep in touch easily with HKDS!

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.