221024 Newsletter

This is the newsletter you get if you sign up (FREE) below to see the stock screeners favorite this week. You also get to immediately download the 25 highest yield Dividend Growth Stocks.

If you need a deeper level and full spectrum of all Dividend Growth Stocks and Blue Chip Stocks of Hong Kong including the stock screener to optimize your (or your clients portfolio), it is recommend to become a Champion member.

>Wishing you a great week ahead!

Reading time of this email: 3 minutes. You will come out wiser.

Let’s look to the adventures of our Dividend Growth stocks listed on the Hong Kong stock exchange.

Reminder: All Dividend Growth stocks are packed in the Directory Data Set #1. This is an easy to understand overview in Excel of all companies that have

- 5 years or more of dividend increases

- 5 yr dividend growth rate of 0.001 or higher.

this way you save a huge amount of time in your research to find the right stocks that are eligible for your cash flow generating portfolio.For all things Hong Kong Dividend Growth and Blue Chip stocks , it is highly recommended to follow HKDS at

Twitter

Facebook

Click and keep in touch easily with HKDS!

Based on a lot of data we look for good opportunities for Dividend Income creation and Value Investing . (Dividend Growth, Risk of not getting any Dividends and Value for Price)

What do we see this week?

– Last week what stands out? A Dividend Contender in trouble or is this a glitch?

– Champion Members: Another Champion for you to look at.

– The 25 highest yield dividend growth stocks. And it is not the 68% yield of the #1

– Hong Kong Dividend Growth Stocks averages on October 24, 2022:

– Great links you can not miss out on

If you have special request for data sets. Just let me know, ASAP. Just click ‘reply’. It would be fun to make customized files.

– What stands out.

The price for HKG:0002 CLP is at an all time low and the yield is now over 5%. It used to be around 3%.

CLP is a Dividend Contender that pays their shareholders 4 times a year. Last week they announced their payment for the 3rd quarter a steady HK$0.63 .

- almost 2%, 5-yr average dividend growth.

- almost 6% yield

- close to 52-week low

- P/B 1.18

- BETA: 0.33

Is this Dividend Contender in trouble or is this a glitch? Let me know what you see and think.

-Champion Members: As you can see in the Directory of all Dividend Growth stocks: The Dividend Aristocrat HKG:1038 CKI Holdings is yielding at 7%.

True, the dividend growth is not spectacular. Also the payout ratio is above average what we would like to see.

Yet it is close to it’s 52-week low at this moment. This might be a bargain you can take advantage of.

-The 25 highest yield dividend growth stocks

are updated. that .xls file you will find on the free members page (active link in email) and the Champion members page.

In this weeks update of the 25 Dividend Growth Stocks with the highest yield:

A columns that we use in the complete list of Dividend growth stocks to see in which category a company is.

Challengers, 5-10 years of dividend growth.

Contenders, 10-25 years of paying more to their shareholders and

Champions/Aristocrats that did not lower their payouts for over 25 years

It makes sense to think the dividend contenders are more reliable in their dividend policy than challengers. That is why this is a good start to filter and deduct possibilities and come to a company that suits your portfolio.

Another thing that is remarkable in this list, HKG:0868 XinYi Glass is a Blue Chip, yielding over 10% at this moment.

You can download this free file here (active link in email) and see for your self.

Let me know what you see and think.

–Hong Kong Dividend Growth Stocks averages on October 24, 2022,

Of all Hong Kong Dividend Growth stocks:

- The average yield of all companies in the Directory is 7% . NOTE: There is one company with 68% yield that is pulling up this average.

- Of all these stocks the average 5-year-average-dividend-growth is 20%.

- 1-year-average Dividend growth is 15%

- When we do: yield 7% x growth 20% => 10%-Yield-on-Cost will be in 4 years.

- Average Price-to-Earnings ratio (P/E) is: 10

Updated links you can not miss out on:

- The latest top 10 Highest Yield Dividend Growth stocks

- Download 25-Highest-yield Dividend Growth Stocks (active link in email)

- Upcoming Ex-Dividend dates this month

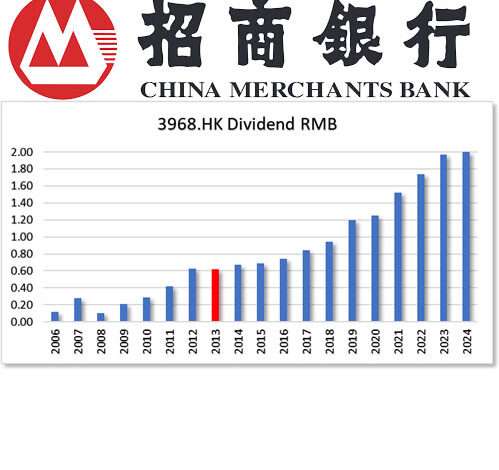

- Watch some Beautiful Dividend Charts

- How to get all dividend growth companies

The Directory is part of the Champion Membership and updated weekly. There is even an easy-to-use stock screener build in, so out of all dividend growth stocks you see in 1 second how they perform on dividend growth, Risk and Value.

Just to make your life easier.

If you have a question, recommendation, or bright idea, be sure to let me know. Just reply to this email.

Wishing you a happy day,

Petra @ Hong Kong Dividend Stocks

One more thing: to keep track on all things Hong Kong Dividend and Blue Chip stocks, it is highly recommended to follow HKDS at

Twitter

Facebook.

Click and keep in touch easily with HKDS!

Kind reminder, this is data, numbers. In no way this is financial advice. (nor legal, nor medical).

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.