News

Latest News

Features and Events

Express News

Culture News

Editor Picks

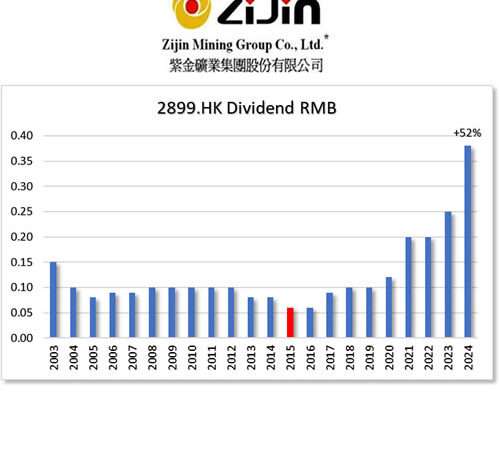

HKG:2899 Zijin Mining

HKG:2899 Zijin Mining

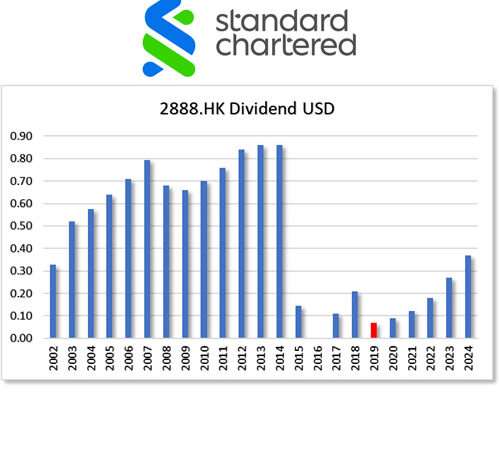

HKG:2888 Standard Chartered PLC

HKG:2888 Standard Chartered PLC

Standard Chartered PLC (HKG:2888) reported robust financial performance for 2024, with several key highlights:

-

Profit Growth: The bank achieved a pre-tax profit of $6 billion, an 18% increase from $5.1 billion in the previous year.

-

Income Achievement: Total income reached a record $19.7 billion, driven by strong performances in Wealth Solutions (up 29%) and double-digit growth in Global Markets and Global Banking.

-

Shareholder Returns: A new $1.5 billion share buyback was announced, along with a final dividend of 28 cents per share, bringing total shareholder distributions since the 2023 full-year results to $4.9 billion.

-

Sustainable Finance: The bank generated $982 million in sustainable finance income, a 36% year-over-year increase, nearing its $1 billion annual target set for 2025.

These results underscore Standard Chartered’s strategic focus on high-growth markets and its commitment to integrating sustainability into its core operations.

HKG:2357 Avi China

HKG:2357 Avi China 0

HKG:1475 Nissin Food

HKG:1475 Nissin Food

Nissin Foods: A Dividend Growth Powerhouse with Iconic Brands

Nissin Foods (HKG:1475) is a leader in the instant noodles industry, renowned for bringing convenient, high-quality meals to households across Asia. Founded in Japan and operating in Hong Kong and China, the company combines culinary innovation with a strong market presence.

Nissin’s top brands include:

- Cup Noodles – The iconic instant noodle loved worldwide.

- Demae Iccho – Known for its rich soup bases.

- U.F.O. – Bold, stir-fried instant noodles.

With its iconic products and consistent dividend growth, Nissin Foods is a compelling choice for investors seeking quality and returns.

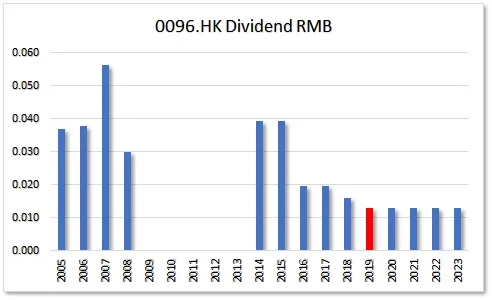

HKG:0096 Yusei

HKG:0096 Yusei The principal activities of the Group are moulding fabrication, manufacturing and trading of moulds and plastic components.

HKG:2669 China Overseas Property Holdings Ltd.

HKG:2669 China Overseas Property Holdings Ltd. China Overseas Property Holdings Limited (2669.HK) is an investment holding company principally engaged in the provision of property management services. This enterprice operates its business through two segments. The Property Management Services segment is engaged in the provision of property management services to mid- to high-end residential communities, commercial properties, government properties and construction sites, including security, repairs and maintenance, cleaning and garden landscape maintenance service. The Value-added Services segment is engaged in the provision of engineering services, community leasing, sales and other services.

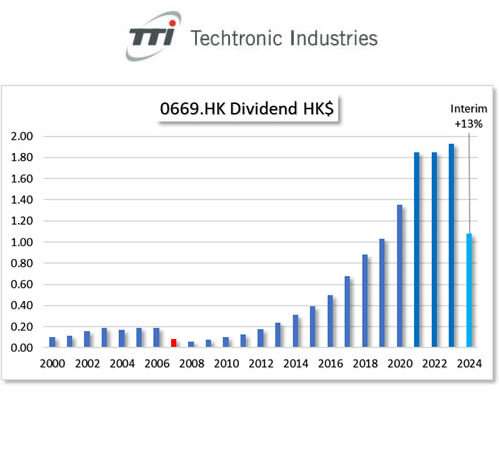

HKG:0669 TECHTRONIC IND

HKG:0669 TECHTRONIC IND 0

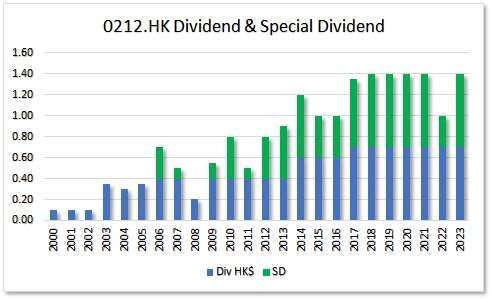

HKG:0212 NanYang Holding

HKG:0212 NanYang Holding The Group is engaged in property investment and investment holding and trading. NanYang Holding (HK0212.HK) A dividend Contender. Although the dividend growth is not on a year on year base, the has not been a dividend decrease since 2008.

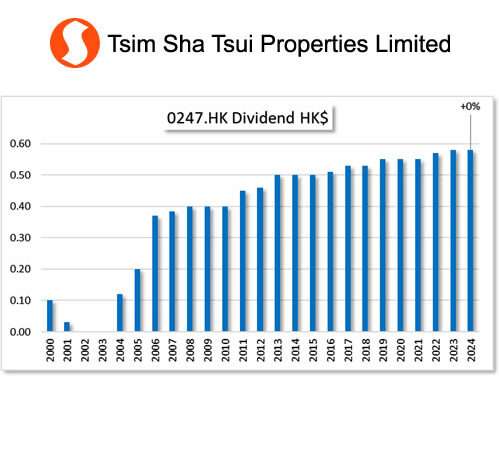

HKG:0247 TST PROPERTIES

HKG:0247 TST PROPERTIES It is a characteristic of a contender. The dividend growth is slow and steady.

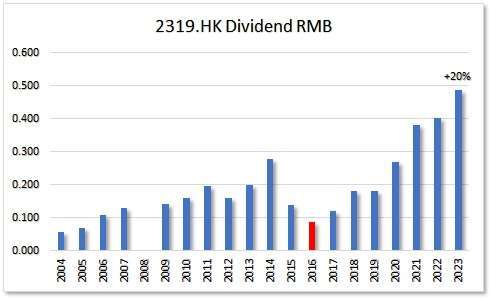

HKG:2319 Meng Niu

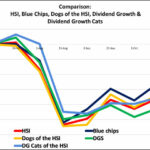

HKG:2319 Meng Niu Mengniu is a leader in China’s dairy industry. 2023 Came with a 20% dividend raise. This 7 year Dividend Challenger is also a Hong Kong Blue Chip. Let’s look at more numbers on dividend growth: