News

Latest News

Features and Events

Express News

Culture News

Editor Picks

HKG:1299 AIA Group Ltd.

HKG:1299 AIA Group Ltd. What a picture, this dividend chart. Textbook Dividend Growth company. Although the yield is low with this price, the growth rate is exponential. Dividend payout ratio is a healthy 30%. There might be a bit overvalue in the price if you look at the P/E, but this is a Hong Kong Blue Chip company. They come for a price.

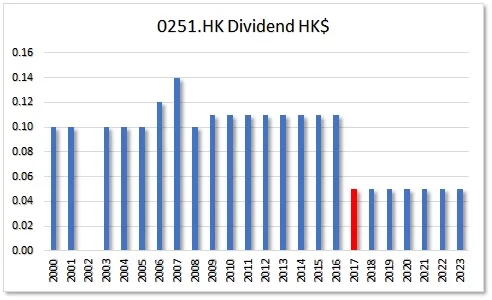

HKG:0251 Sea Holdings

HKG:0251 Sea Holdings The activities of the group were property investment, property development, hotel operation and financial investment in Hong Kong and the United Kingdom.

HKG:0374 FOUR SEAS MER

HKG:0374 FOUR SEAS MER Four Seas Mercantile Holdings Limited (0374.HK) is a Hong Kong-based investment holding company principally engaged in food businesses. The Company operates through two segments. The Hong Kong segment is engaged in the operation of restaurants, the manufacture and trading of snack foods, confectionery, beverages, frozen food products, ham and ham-related products and noodles, as well as the retailing of snack foods, confectionery and beverages.

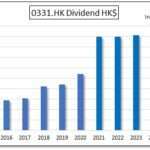

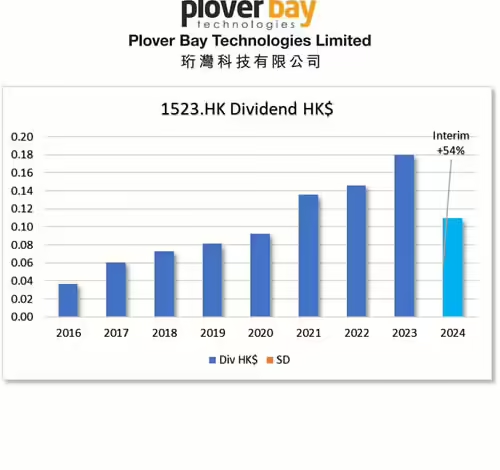

HKG:1523 Ploverbay

HKG:1523 Ploverbay This particular Dividend Challenger shows strong potential. If the trend of increasing dividends continues as it has been, excluding the Special Dividend of 2023, it is projected to reach the 10% yield to cost milestone by 2025.

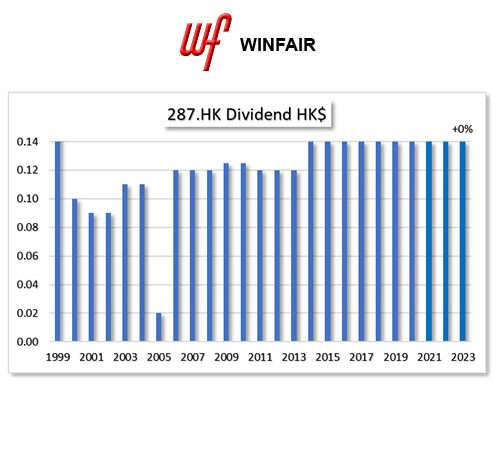

HKG:0287 WINFAIR INV

HKG:0287 WINFAIR INV WinFair Investment LTD 0287.HK is a Hong Kong-based investment holding company principally engaged in property and security businesses. The Company operates through three segments. Securities Investment segment is engaged in long-term investment in securities and short-term trading of securities. Property Leasing segment is engaged in the leasing of properties. Property Development segment is engaged in the construction of development properties. The properties under the Company include No. 96 Bonham Strand East, Sheung Wan,Hong Kong, the third floor of No. 92 Bonham Strand East, Sheung Wan and the ground floor of Nos. 8 and 10, Nam Kok Road, Kowloon, among others.

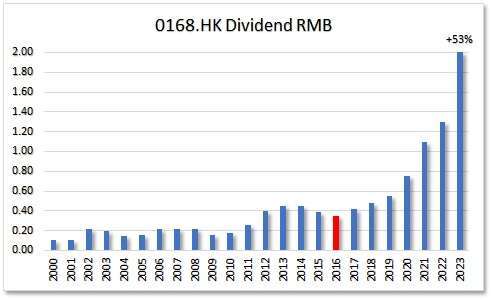

HKG:0168 TsingTao Brew

HKG:0168 TsingTao Brew Beer, the most famous beer in China probably. Dividend 2022 also came with a special dividend of RMB 0.50. (not on the chart ) EPS growth for 5 years in a row. Beer seems covid proof if we look at the results of this company.

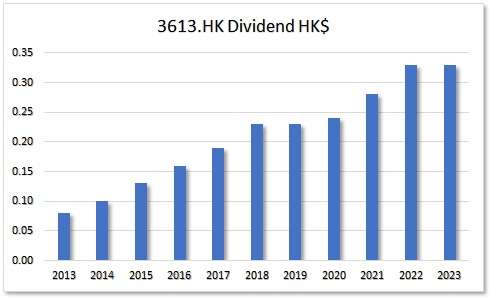

HKG:3613 Tong Ren Tang

HKG:3613 Tong Ren Tang 1H 2022 a special dividend was announced. Final dividend got a raise of 17%. This company is heading to become dividend contender next year. And let’s not forget the beautiful dividend chart. The special dividends is left out conveniently.

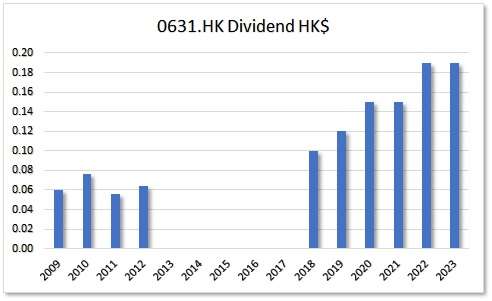

HKG:0631 Sany Int’l

HKG:0631 Sany Int’l This company is mainly engaged in manufacturing and selling mining equipment, logistics equipment, robotic and smart mined products and spare parts and the provision of related services in Mainland China.

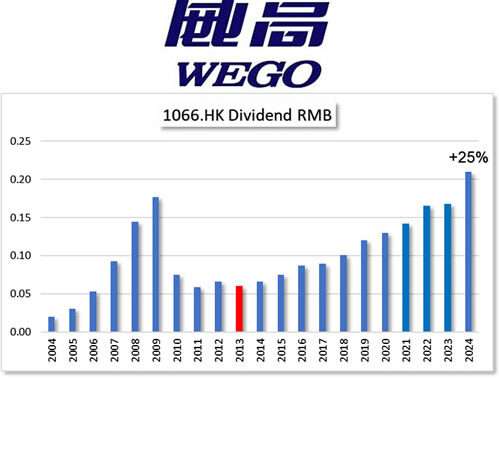

HKG:1066 Weigao Group

HKG:1066 Weigao Group Results of 1H 2022 got us a 11% increase of interim dividend. EPS and Net Prof inclined 17% , while D/E increased 1%. This brings a positive outlook.

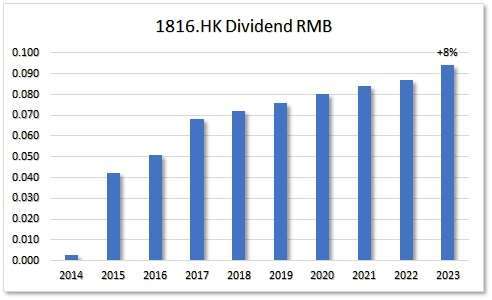

HKG:1816 CGN Power

HKG:1816 CGN Power production and supply of electricity and heat generated mainly from nuclear energy