News

Latest News

Features and Events

Express News

Culture News

Editor Picks

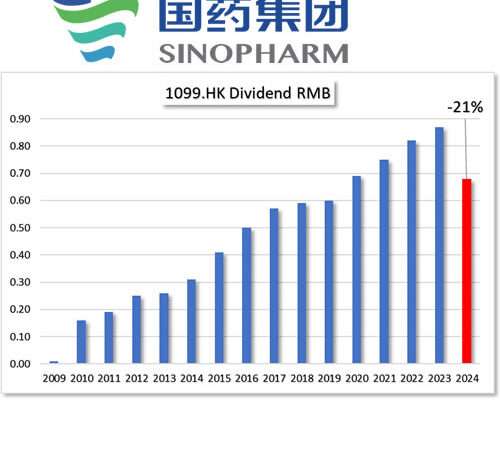

HKG:1099 SINOPHARM

HKG:1099 SINOPHARM Dividend is in RMB also here. Other than that, things look nice. Not too splendid on the yield side , but consistent growth in dividend. So sit and wait till the time is right.

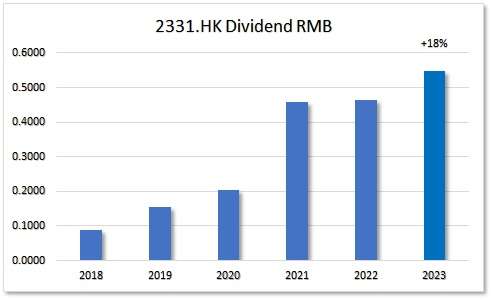

HKG:2331 Li Ning

HKG:2331 Li Ning Li Ning is a sports apparel and shoes brand, since 1990.

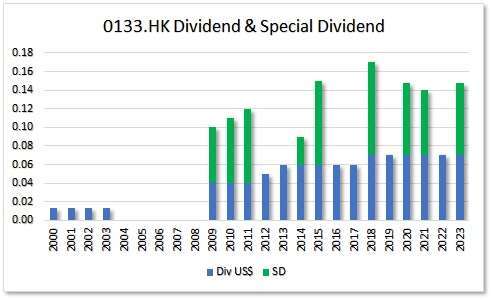

HKG:0133 China Merchants

HKG:0133 China Merchants China Merchants HKG:0133 has a good yield, pay out ration and dividend coverage ratio! EPS growth is up and down.

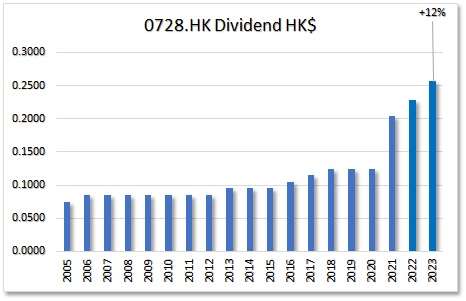

HKG:0728 CHINA TELECOM

HKG:0728 CHINA TELECOM A steady Contender. The average 5 year dividend growth exceeds inflation numbers. Also remarkable, this company never decreased their dividends. Results over 1H 2022 even gave an interim dividend. That did not happen before.

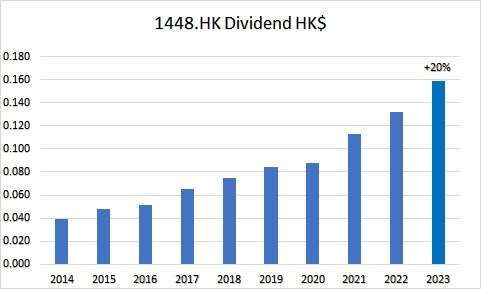

HKG:1448 FuShouYuan

HKG:1448 FuShouYuan They are in the funeral business. Delightful payout patio. Yield could be better. The market has high hopes for this stock when we look at the P/E and P/B ratios.

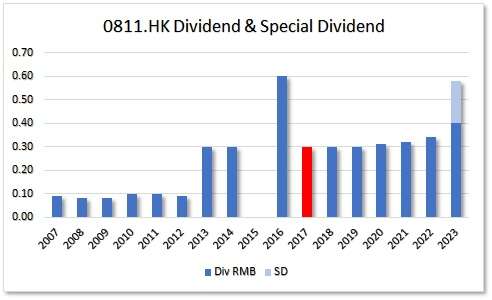

HKG:0811 Xinhua Winshare

HKG:0811 Xinhua Winshare The Group is mostly involved in: selling books, newspapers, and digital publications; supplying audio-visual products to chain stores only; making digital publications and audio-visual products; creating audio and video tapes; handling logistics; and selling pre-packaged food, dairy products (excluding infant formula), and printing publications and other printed items.

HKG:0762 China Unicom

HKG:0762 China Unicom This is a weird Dividend pattern. The Growth strategy does not seem applied, more like a random raises. The other news is, that this Company is also a Hong Kong Blue Chip. And then, 27% Dividend growth over 2022.

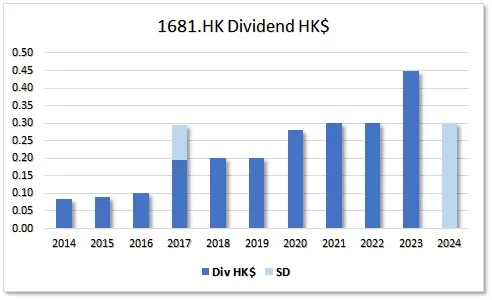

HKG:1681 Consun Pharm

HKG:1681 Consun Pharm The pharmaceutical products of the Company include kidney medicines, contrast medium and others. The Company’s subsidiaries include Brilliant Reach Group Limited, Century International Develop Limited and Grand Reach Company Limited. Through its subsidiaries, the Company is also engaged in the research and development of pharmaceutical products.

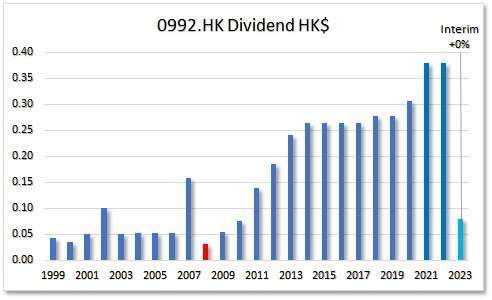

HKG:0992 Lenovo Group Ltd.

HKG:0992 Lenovo Group Ltd. a Dividend Contender. No dividend decrease since 2009.

HKG:1083 TOWNGAS CHINA

HKG:1083 TOWNGAS CHINA This company became a dividend contender in 2019.This company never had a dividend decrease so far! Dividend growth ratio is utterly boring. No raise in the last 6 years. Also not over the year 2022. Slow and steady. Let’s look at the numbers now: