World News

Latest News

Features and Events

Express News

Culture News

Editor Picks

HKG:0384 CHINA GAS HOLD

HKG:0384 CHINA GAS HOLD Glorious Dividend Contender: China Gas Holding (0384.HK) . Most Contenders/Achievers do not have a high dividend growth rate. This is an exception. Almost 17% average dividend growth over 5 years and about 8 years to get to 10% yield on costs.

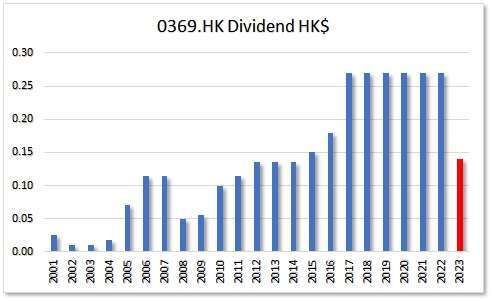

HKG:0369 WING TAI PPT

HKG:0369 WING TAI PPT Wing Tai Properties (0369.HK) is a Dividend Contender. The years that were skinny, they froze the dividend, never decreased in 13 years. The last couple of years the dividend growth stagnated to zero. A good high yield is making up for it. Also dividend p

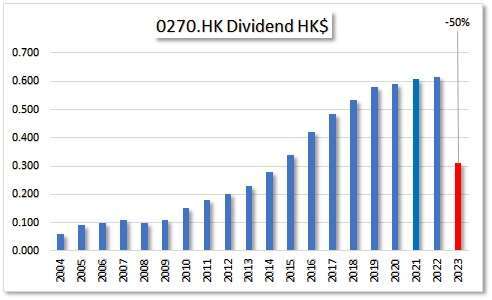

HKG:0270 GUANGDONG INV

HKG:0270 GUANGDONG INV The Group is principally engaged in water resources, property investment and development, department store operation, hotel ownership, operation and management and infrastructure (energy projects and road and bridge operation).

HKG:0222 Min Xin Holding

HKG:0222 Min Xin Holding Min Xin Holdings (0222.HK) a conglomerate involved in many businss endeavours. A brilliant payout ratio

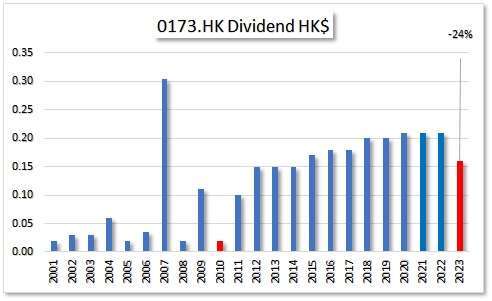

HKG:0173 K. WAH INT’L

HKG:0173 K. WAH INT’L This company has recently reduced its dividend payout. This follows a significant decline in earnings per share (EPS) over the past two years. The lower EPS resulted in an unsustainable payout ratio, necessitating a reduction in dividends to maintain fina

HKG:0017 New World Development Co. Ltd.

HKG:0017 New World Development Co. Ltd. Dividends totaled $1.89, including a final dividend of $0.3 and a conditional special dividend of $1.59, compared to a final dividend of $1.5 in the same period last year. The special dividend is conditional upon the completion of the disposal of approxim

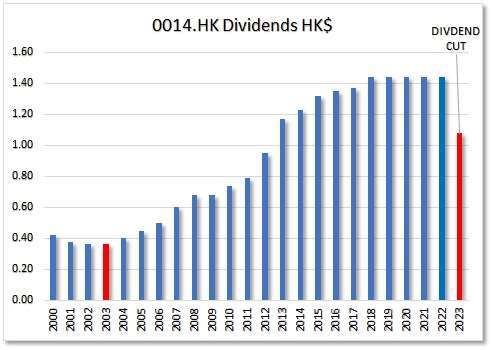

HKG:0014 Hysan Development Co. Ltd.

HKG:0014 Hysan Development Co. Ltd. The Group’s principal activities are property investment, management and development. This dividend Contender’s departure was expected after a 25% cut in dividends. Their dividend payout ratio had been too high for three years straight. On the bright side

HKG:0160 Hon Kwok Land Investment

HKG:0160 Hon Kwok Land Investment Hon Kwok Land Investment Company 0160.HK, Limited is a Hong Kong-based investment holding company principally engaged in property businesses. The Company operates through three segments. The Property Development segment is engaged in property development.

Dogs of the Hang Seng mid-year results

July 1, we are half way through 2024. Let’s look at the Dogs of the Hang Seng mid-year results. To get you up to speed quickly, What are the Dogs of the Hang Seng? The Dogs of the Hang Seng are the 10 highest yielding Blue Chip companies at the end of a calendar year. […]

1-What is Dividend Growth Investing?

What is Dividend Growth Investing? Dividend Growth Investing (DGI) is a long-term, buy-and-hold investment strategy—typically held for 5 years or more—that focuses on building a growing stream of income over time. Think of it like planting a tree. Once planted, the tree steadily grows, producing more fruit each year. Even if the tree stops growing […]