The purpose of the Champion membership is two-fold:

- For Dividend Growth Investors or investors that want to supplement their portfolio with income generating stocks.

- For International Investors looking for long term (buy-and-hold) opportunities.

Put simply, the Champion membership is your investment guide to income and value generating stocks on the world renowned Hong Kong stock exchange.

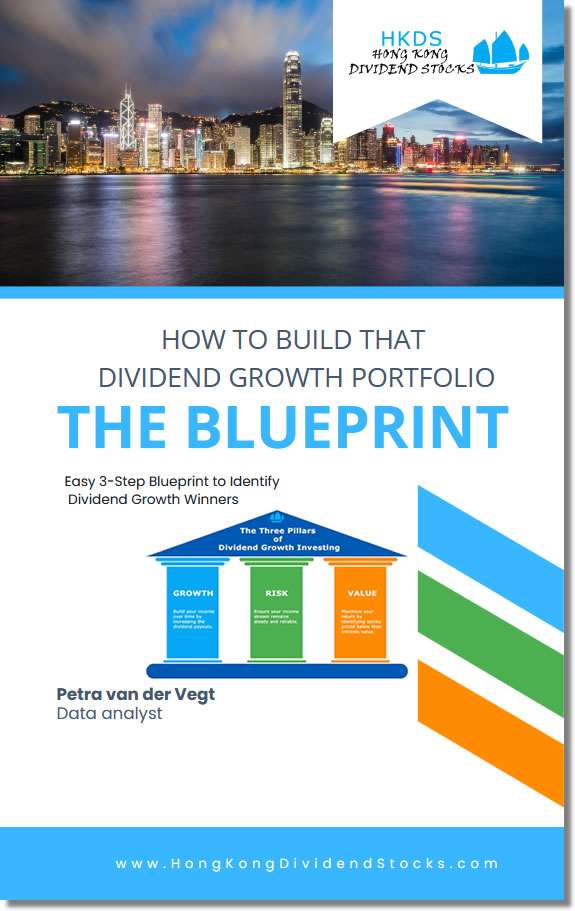

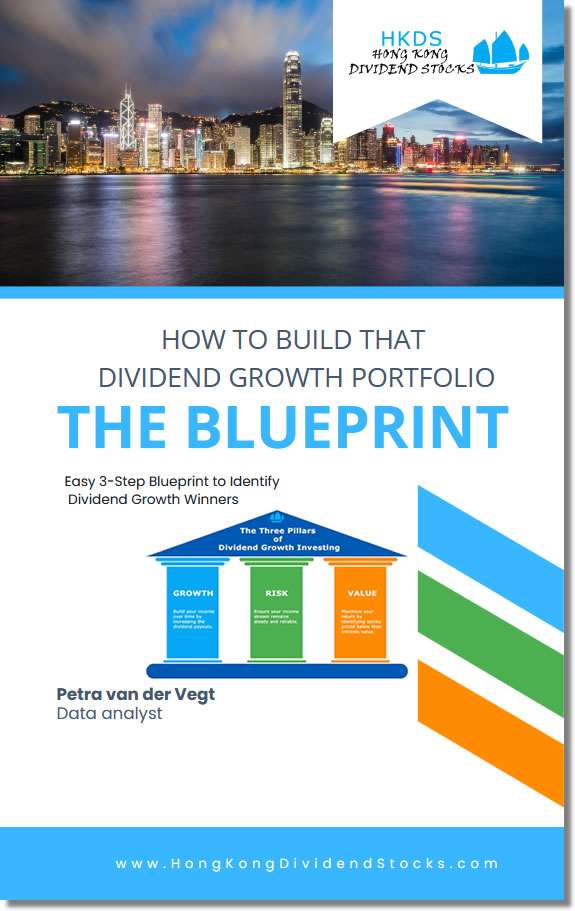

The Blue Print Clarity on the 3 Pillars:

Get a simple, step-by-step breakdown of the three key criteria that separate the long-term winners from the rest of the pack. No guessing—just a proven framework

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.

Build that portfolio

One last thing:

We do really cool stuff over there!

[contact-form-7 id=”120″ title=”Contact form 1″]

Error! The button ID (6591) you specified in the shortcode does not exist. You may have deleted this payment button. Go to the Manage Payment Buttons interface then copy and paste the correct button ID in the shortcode.

Click ‘Buy Now’ button.

it will redirect you to the Paypal site.

After your payments is received,

you can create your login.

Thank you for your support.

[woocommerce_checkout]