Discover the “Dogs of the Hang Seng” for 2025: High Dividend Stocks on the HKEX

Discover the “Dogs of the Hang Seng” for 2025: High Dividend Stocks on the HKEX

As part of our annual tradition, we take inspiration from the “Dogs of the Dow” concept and apply it to the Hong Kong Stock Market. The result? The “2025 Dogs of the Hang Seng,” a fascinating list to kick off the year with fresh perspectives on dividend stocks.

Please note: As with all content on this website, this is not financial advice. It’s purely entertainment with numbers to spark ideas and discussions.

The Theory Behind the Strategy

- Identify Top-Yielding Blue Chips:

On December 31, screen all Hong Kong Blue Chip stocks to identify the top 10 companies with the highest dividend yields. This analysis is based on dividends paid during the most recently completed financial year. - Allocate Investment Funds:

Assign HK$10,000 to each of the 10 selected companies, creating a portfolio evenly distributed with HK$100,000. While this may seem impractical for everyday investors, it provides a standardized way to model portfolio performance. - Purchase Stocks:

On January 1 (or the first trading day of the new year), invest in the selected companies based on the results of steps 1 and 2. - Hold the Portfolio:

Maintain your portfolio for the entire year. Collect dividends, and refrain from buying or selling during this period—no matter how tempting market fluctuations may be. - Sell on December 31:

On the last trading day of the year, liquidate your portfolio and prepare for the next cycle. - Repeat Annually:

Reapply this process each year to build a consistent, data-driven investment strategy.

Why This Strategy could Work

This approach is rooted in the belief that Blue Chip stocks—known for their financial stability, profitability, and resilience—tend to outperform during turbulent markets. High-yield Blue Chips, in particular, may offer two key advantages:

- Attractive Valuation: High yields often indicate that the stock is undervalued, presenting potential for both income and capital appreciation.

- Steady Income: Reliable dividends provide a consistent income stream, enhancing portfolio returns.

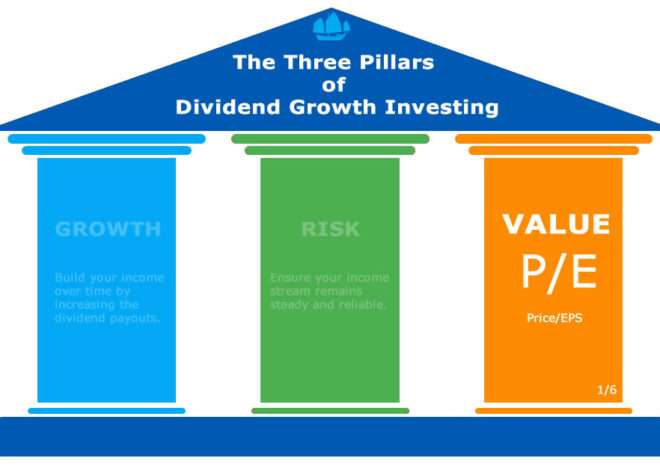

By systematically selecting top-yielding Blue Chips and holding them for a year, you create an efficient and disciplined investment process that aligns with the principles of dividend investing.

Find Out which of the Hong Kong Stocks Have Dividend Growth Potential—Skip Hours of Research |

So, now you know. Here we go.

Presenting: The 2025 Dogs of the Hang Seng!

Ladies and gentlemen, investors and enthusiasts, the spotlight is on!

After rigorous analysis and a deep dive into the Hang Seng Index, we’re thrilled to unveil the top 10 highest dividend-yielding blue-chip stocks for 2025. These market champions don’t just offer robust income potential—they come with exciting opportunities for capital appreciation, combining stability with growth.

So, grab your portfolios and get ready to meet the contenders that could redefine your dividend strategy for the year ahead!

(what do you think, too much?)

| No. | Ticker | Company | Sector | Price HK$ 1-Jan | Yield over 2024 |

| 1 | HKG:0101 | Hang Lung Property | Property Investment | 6.23 | 12.52% |

| 2 | HKG:0386 | Sinopec | Petroleum & Gases | 4.45 | 9.09% |

| 3 | HKG:0857 | PetroChina | Petroleum & Gases | 6.11 | 8.57% |

| 4 | HKG:1929 | Chow Tai Fook | Watch & Jewellery | 6.73 | 8.17% |

| 5 | HKG:1088 | China Shenhua | Coal | 33.60 | 8.00% |

| 6 | HKG:0868 | XinYi Glass | Industrial Goods | 7.89 | 7.98% |

| 7 | HKG:0823 | Link REIT | Realestate Investment Trust | 32.85 | 7.98% |

| 8 | HKG:0012 | Henderson Land | Property Development | 23.60 | 7.63% |

| 9 | HKG:0836 | China Res Power | Electricity | 18.88 | 7.49% |

| 10 | HKG:1044 | Hengan | Cosmetics & Personal Care | 22.45 | 7.42% |

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.