Dogs of the Dow vs. Dogs of the Hang Seng 2021

The Dogs of the Hang Seng (DotHS) is a deviation of the Dogs of the Dow (DotD). It was set up to see if that famous Dow Jones investment strategy could hold water here in Hong Kong.

This article is not about which dogs did better. That said, it makes the title Dogs of the Dow vs. Dogs of the Hang Seng 2021 not any less spectacular.

The goal is to see how the 2 portfolios did using the same (or similar) strategy on totally different markets.

What is this Dogs of the .. strategy and how does it work?

The Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Index (DJIA) after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds them for the entire next year. (Source)

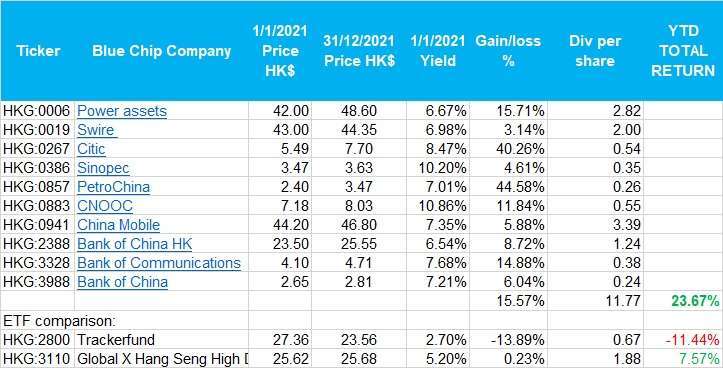

For the Hang Seng equivalent you take the 10 Blue Chip Companies that have the highest yield at January 1. Each position of HK$10,000 so the total investment is HK$100,000

Then just sit and wait. Until December 31 and see how much your investment is worth and calculate dividends received over that year.

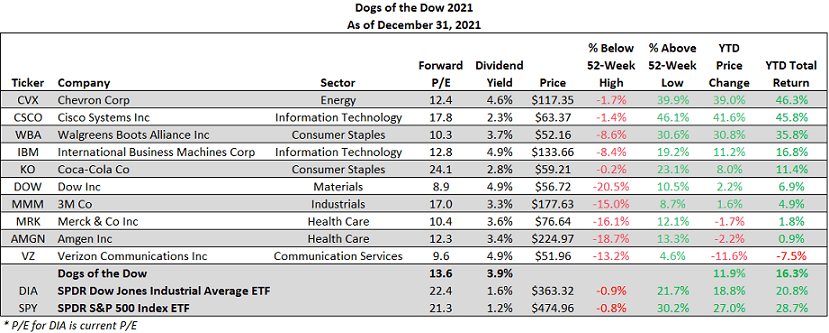

Now, let’s look at the performance of the DotD.

Luckily Mr. Templeton wrote a comprehensive article on Seeking Alpha. You can check that out here . He came to the following:

The DotD did an amazing 16%. Which is a good performance. Only 3 listings went in the red.

In the other corner we have the Results of DotHS :

A flashback, the year 2020 did not go so well for the Hang Seng Pack. This post has the dirty details. 2020 ended -20% for the DotHS while the Hang Seng Index (HSI) closed that year -3%. Ouchh

The following year, 2021, logged a better performance. The Dogs of those 12 months raised plus 23% incl dividends. The HSI closed 15% lower. The details you will find here, in this post.

Score 50-50

Something that is a difference compared to the Dogs of the Dow with Mr. Templeton: The results are hold against the performance of 2 ETFs. The result of The Hang Seng Dogs is hold to the HSI in it self.

Let’s get 2 ETFs that hold a portfolio similar to the DotHS.

HKG:2800 Trackerfund. Performance 2021: -13% excl yield. Yield 2.4%

HKG:3110 Global X Hang Seng High Dividend Yield ETF. Performance 2021: +0.002% excl yield. Yield: 7.3%

That will make things look like this:

The DotHS outperformed the 2 ETFs. Where the DotD were outperformed by their ETF counterparts.

Still, both packs of dogs performed well in a year that was not easy and quite edgy.

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.