Dogs of the Hang Seng

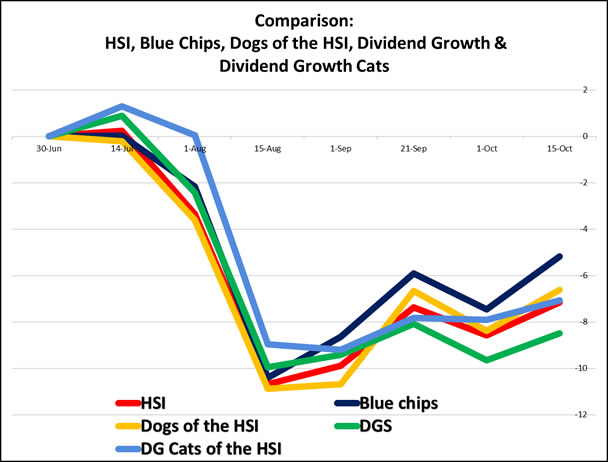

Comparing the Hang Seng Index, the Dogs of the Hang Seng, the Dividend Growth cats, and the complete directory of Hong Kong Dividend Growth Stocks.

Here at HKDS we focus on income generating stocks that give a raise every year. This Hang Seng Dog-project researches if the Dividend Growth Stocks also grow as an asset.

The hypothetical case is: you put in HK$ 10.000 on each company in either of these packs. Will they beat each other and how do the results compare to the hang Seng Index.

There for a comparison is made between,

1- HSI (Red line)

2- Hong Kong Blue chips (Navy line)

2- The Dogs of the Hang Seng, (Yellow line)

3- The Cats of the Dividend Growth directory and (Blue Line)

4- The complete directory of Dividend growth stocks (Green line)

Dividend Growth Investing (DGI) is focused on the income you create with your investments by collecting dividends year after year. With the growth being the raises you get annually without getting anxious of how well you investment is doing.

Good news is, that the highs and lows of the market will matter less for your income. Cash flow is king.

That said, it would still be a curious ride to see how your asset is doing against the Hang Seng Index and the Blue Chips. Seeing your principal grow just feels good.

There for the Dogs of the Hang Seng are a benchmark. This part is easy:

- Take the 50 constituents/ Blue Chips, here or here

- Check their dividends,

- Calculate the yield

- Select 10 companies with the highest yield

- Normally this is done on December 31. No time as the present, so this experiment starts June 30 and will end December 31 2019

- Invest an equal amount HK$ 10.000 in each company, total HK$ 100.000 and see what this brings on December 31.

And here are the Dogs of the Hang Seng June 30 2019:

| HKG:0386 | SINOPEC CORP |

| HKG:3988 | BANK OF CHINA |

| HKG:1088 | CHINA SHENHUA |

| HKG:0005 | HSBC HOLDINGS |

| HKG:3328 | BANKCOMM |

| HKG:0939 | CCB |

| HKG:1928 | SANDS CHINA LTD |

| HKG:0883 | CNOOC |

| HKG:1398 | ICBC |

| HKG:0006 | POWER ASSETS |

And what about the Dividend Growth Dogs of the Hang Seng? Besides the high yield and the dividend growth pattern of at least 5 years, would that be an even better investment?

Applying the same rules using instead of the Blue Chips of the Hang Seng, the directory of all Dividend Growth Stock on the Hang Seng.

This are the Dividend Growth Cats of the Hang Seng June 30 2019:

| HKG:6033 | Telecom Digi |

| HKG:3315 | Gold Pac Group |

| HKG:1127 | LION ROCK GROUP |

| HKG:3828 | MING FAI INT |

| HKG:0086 | Sun Hung Kai & Co. Ltd. |

| HKG:1050 | KARRIE INT’L |

| HKG:0551 | YUE YUEN IND |

| HKG:0034 | Kowloon Development Co. Ltd. |

| HKG:0008 | PCCW Ltd. |

| HKG:1333 | CHINA ZHONGWANG |

The purpose its to see where the figures will take us. Do not see this as professional advise in any way. Always consult a professional before investing.

Because of the fun of this, subscribers will find a monthly update together with their update on the 25 highest Dividend Growth stocks list. Subscribe here for free

For Premium members, for the hope of gaining better insights, all the companies in the directory have been put in 1 sheet on June 30 and we are going to see which Contenders and Challengers will have the most rise in price and if they ‘beat the market!’

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.