210922 Property sector after Evergrande crisis

This month was HKG:3333 Evergrande’s unfortunate month. The property giant stock loss were tremendous.

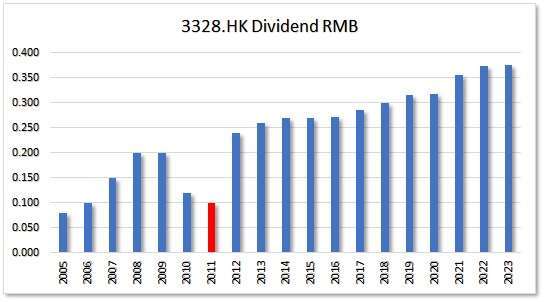

In this document .xls we look at the property sector of all Hong Kong Dividend growth stocks. We look for risks in debt/liabilities.

There for 3 extra metrics are added. These 3 are the 3 Red Lines China pressed upon to keep this sector healthy

- a maximum debt-to-asset ratio of 70%, [Evergrande 84%]

- 100% cap on net debt to equity ratio (Short term + long term liabilities – cash at hand)/equity) [Evergrande 505%]

- cash at least equal to short-term borrowing, minimum 100% [Evergrande: 53.8%]

An other point, some stocks dropped in price. Columns were added that

- Compare price of September 17 to September 21 (closing)

- The value part of the stock Screener of September 17

Ironically the biggest losers are all in the green on their Liability metrics.

Log in, to see this page |

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.