HKG:0017 New World Development Co. Ltd.

HKG:0017 New World Development Co. Ltd. operates in the field of Property investment. Dividends totaled $1.89, including a final dividend of $0.3 and a conditional special dividend of $1.59, compared to a final dividend of $1.5 in the same period last year. The special dividend is conditional upon the completion of the disposal of approxim

HKG:0017 New World Development Co. Ltd.

Last update: 3-Aug-24

Quick overview:

-

- Yield: 10.69%

(See here Top 10 highest yield)

-

- Lot: 1000

- Price/Earnings ratio : 37.42 (Ideal <20 )

- Earnings per share : 0.190 (Ideal >0.001)

- Price as per 3-Aug-24 : HK$7.11

- Ex-Dividend Date coming up: N/A

See here all upcoming Ex-Dividend dates

2024 Interim results: Expected Soon

Sector: Property investment

0

Dividend GROWTH related metrics

-

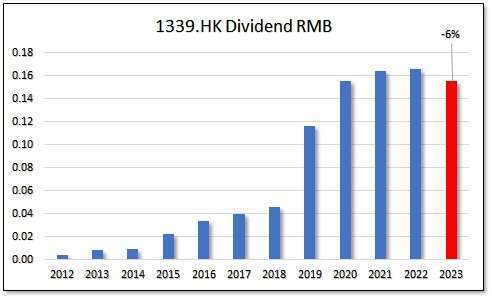

- Average dividend growth 1 year : -63.11%

- Average dividend growth 3 years : -11.98%

- Average dividend growth 5 years : 4.94% (Ideal >5%)

- 10% on costs in how many years: 1. How long does it take to get to 10% Dividend yield on Costs? Yield x 5-yr Average dividend growth

- Chowder rule (Yield + 5 yrs average dividend growth) : 15.63%. Ideal would be >15

- Yield 5 yr average: 6.24%

0

Let’s talk money:

Total Dividends last year: 2.06 per share

Expected Dividends: 2.16 per share. Per lot: 2,161.82. Dividends last year x 5-yr average Dividend growth.

Dividends come in: HKD Mostly it will be in HKD, yet some are expressed in RMB/USD/CAD

Miscellaneous data on Dividends of the company:

- Dividend since : 2002

- Dividend growth since : 2010

- No of years Dividend Growth:

- That makes this company a Contender

- Payouts/year: 2

- Payout in the following months : 5, 12.

- Ex-date : N/A

- Latest dividend announcement: HK$ 0.30

The Data on Risk of not getting a Dividend cut or worse, not getting any Dividends at all:

- Earnings per share : 0.190 (Ideal >0.001)

- Dividend payout : 602.56% (Ideal <50%)

- Dividend Coverage ratio: 0.092 Ideal >2

- EPS 5 year growth rate : 20.73 Ideal anything >0

- Return on Equity: 0.460 Ideal >10

- Years of Dividend Growth: . Aim above 7 years. Also check the Dividend Sheet below.

0

Let’s take a look at the liability ratios:

- Debt/Equity: higher than 1.5 might be tricky

- Cash/Short term debt: 1.02 Ideal >1

- Total Liabilities/Assets: 0.56 Look for <1

- Net Debt/Equity: 1.09 Aim for <1

For banks, insurance companies and other financial institutions these benchmarks on liability ratios will not apply.

Data related to Value

- Price as per 3-Aug-24 : HK$

- Price/earnings ratio : (Ideal <20 )

- 52 Week low : 7.10

- 52 week high : 19.54

- Price to 52 Week Low: 0.14%

- Price to 52 week high: -63.61%

- Graham Number: 19.73 Ideal if this number is higher than current price

- Price/Book: 0.08 <3 would be the sweet spot

This is a Blue Chip company, they never come cheap. Or at least not often. So is this enterprise. On the positive, graham Number and P/B ratio are in in favor of the current price.

Dividend Report (incl Special Dividends, if any), the history, projection on dividend growth and how many year to get 10% Yield-on-Cost

| Dividend Stock Screener 1-100, 1 = very bad, 100 = extremely good. |

||

| GROWTH | 57 | 0 |

| RISK | 15 | 0 |

| VALUE | 50 | This is a Blue Chip company, they never come cheap. Or at least not often. So is this enterprise. On the positive, graham Number and P/B ratio are in in favor of the current price. |

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.