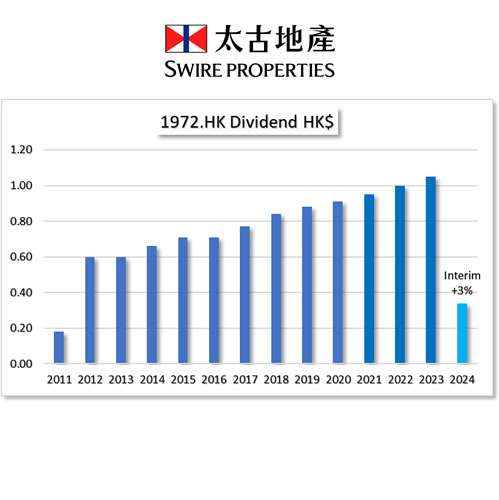

HKG:1972 Swire Properties

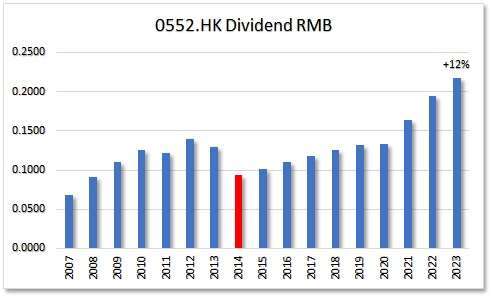

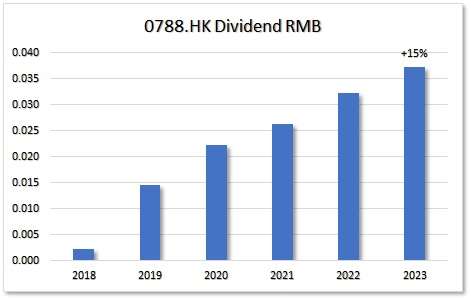

HKG:1972 Swire Properties operates in the field of Property Investment. This dividend contender has good potential in the numbers. 11 Years no dividend decrease. Liability ratio’s look positive. And obvious, we see growth in dividends in this chart. Interim results 2023 look not that super. Net profit got halved. Interim dividend got raised though.

HKG:1972 Swire Properties

Last update: 2-Apr-25

Quick overview:

-

- Yield: 6.36%

(See here Top 10 highest yield)

-

- Lot: 200

- Price/Earnings ratio : 43.42 (Ideal <20 )

- Earnings per share : 0.380 (Ideal >0.001)

- Price as per 2-Apr-25 : HK$16.50

- Ex-Dividend Date coming up: N/A

See here all upcoming Ex-Dividend dates

2024 Interim results: 0

Log in, to see this pageGet access to expert data in 5 minutes |

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.