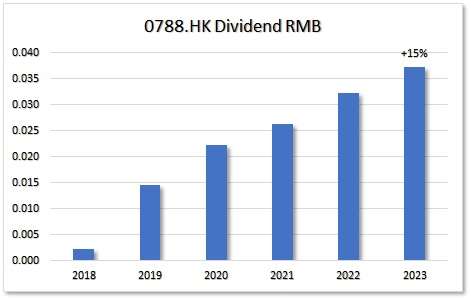

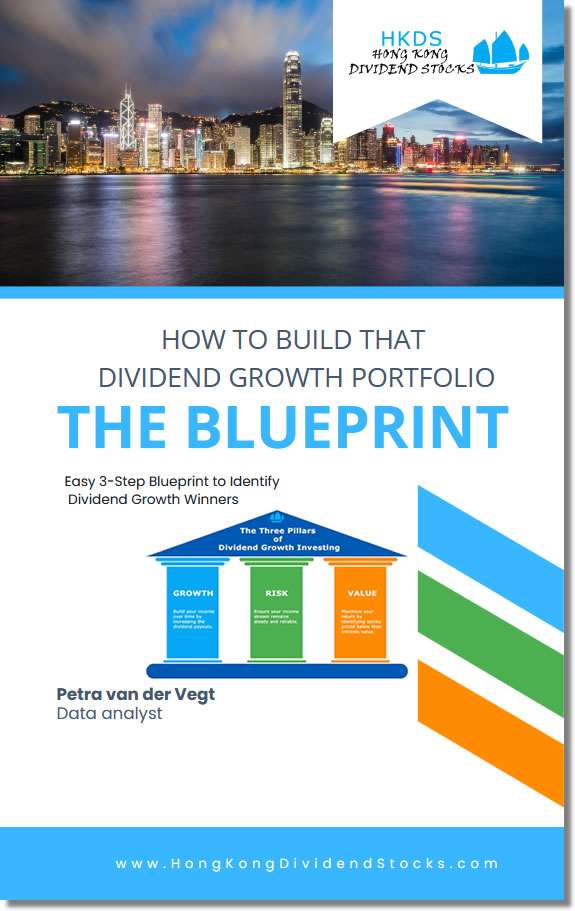

HKG:2688 Enn Energy

HKG:2688 Enn Energy operates in the field of Gas Supply. ENN Energy is one of China’s largest clean energy distributors, supplying residential, industrial, and commercial sectors with natural gas and related energy services. It is also expanding its reach into integrated energy solutions like renewable energy and energy storage, aiming to support China’s carbon neutrality goals. Known for its strong revenue and stable dividends, it often attracts interest from dividend growth investors.

HKG:2688 Enn Energy

Last update: 2-Apr-25

Quick overview:

-

- Yield: 4.65%

(See here Top 10 highest yield)

-

- Lot: 100

- Price/Earnings ratio : 11.26 (Ideal <20 )

- Earnings per share : 5.730 (Ideal >0.001)

- Price as per 2-Apr-25 : HK$64.50

- Ex-Dividend Date coming up: 28-May

See here all upcoming Ex-Dividend dates

2024 Interim results: 0

Log in, to see this page |

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.