Interim Results Hong Kong Blue Chip Stocks

A summary on the Interim Results Hong Kong Blue Chip Stocks 2022.

A short introduction:

At this moment there are 66 Blue Chip companies, also called constituents. A blue chip stock represents a big, mostly well-known company with a high standards. These are mostly well-established and financially sound companies that have operated for many years and that have foreseeable earnings.

Full list, see here. or even better: Sign up below (FREE) and download the file in .xls incl

- price this week

- compared to price January 1, 2022

- PE and

- EPS metrics

(Champion members: on your member page there is Data Set #4 with all details on these interim results. )

Please take notice, this are numbers and therefore data only. By no means is this any investment-, legal- or medical advice.

To draw conclusions of this post , is up to you, dear educated reader.

Most interim result are with ending period of June 30 2022

There are 6 companies that have an altered calendar of their books. Of these enterprises there are no interim announcements yet.

That leaves us with 60 companies. Of which

- 27 reported growth in their EPS compared to interim results last year.

- 7 came with negative net profit.

-

HKG:3690 Meituan E-Commerce & Internet Services HKG:1928 Sands gamble HKG:0002 CLP Holdings Electricity Supply HKG:1299 AIA Insurance HKG:1997 Wharf REIC Property Investment HKG:0027 Galaxy Entertainment gamble HKG:6862 HaiDiLao Restaurants & Fast Food Shops

It might not come as a surprise that the Gamble industry still has a hard time.

- 36 Blue Chip companies announced interim dividends. And oh my, we love dividends.

| HKG:0388 | HKEX | Other Financials |

| HKG:0941 | China Mobile | Telecom Services |

| HKG:2318 | PING AN | Insurance |

| HKG:2313 | ShenZhou International | Apparel |

| HKG:0669 | Techtronic | Furniture & Household goods |

| HKG:0001 | CKH Holdings | Conglomerate |

| HKG:1044 | Hengan | Cosmetics & Personal Care |

| HKG:0006 | Power assets | Electricity Supply |

| HKG:0005 | HSBC | Bank |

| HKG:0011 | Hang Seng Bank | Bank |

| HKG:1038 | CKI Holdings | Conglomerate |

| HKG:1997 | Wharf REIC | Property Investment |

| HKG:0883 | CNOOC | Petroleum & Gases |

| HKG:2688 | Enn Energy | Gas Supply |

| HKG:0002 | CLP Holdings | Electricity Supply |

| HKG:2020 | Anta Sports | Textile & Apparels |

| HKG:9999 | NTES-S | E-Commerce & Internet Services |

| HKG:0012 | Henderson Land | Property Development |

| HKG:2388 | Bank of China HK | Bank |

| HKG:1113 | CH Assets | Property Investment |

| HKG:0066 | MTR | Public Transport |

| HKG:1378 | China HongQiao | Nonferrous Metal |

| HKG:1299 | AIA | Insurance |

| HKG:0688 | China Overseas | Property Development |

| HKG:0960 | LongFor Group | Property Development |

| HKG:0291 | China Res Beer | Alcoholic drinks & Tabacco |

| HKG:0857 | PetroChina | Petroleum & Gases |

| HKG:1109 | China Resources | Property Development |

| HKG:0267 | Citic | Conglomerate |

| HKG:0762 | China Unicom | Telecom Services |

| HKG:0386 | Sinopec | Petroleum & Gases |

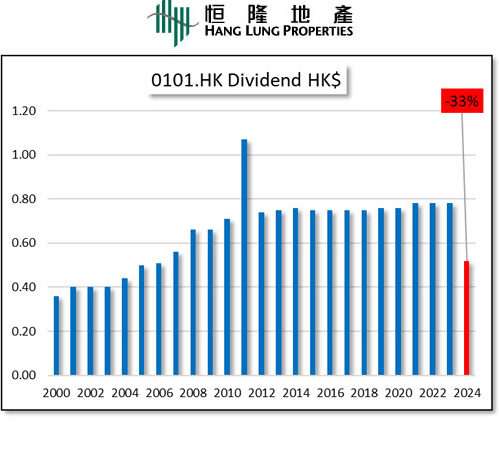

| HKG:0101 | Hang Lung Property | Property Investment |

| HKG:0003 | HK & China Gas | Gas Supply |

| HKG:0968 | XinYi Solar | Environmental Energy Material |

| HKG:1093 | CSPC Pharma | Medicine |

| HKG:1177 | Sino Biopharm | Medicine |

| HKG:0288 | WH Group | Agricultural, Poultry & Fishing production |

- 20 of these dividend paying enterprises even announced an increase in payments to their share holders. Whooohoooo

- 7 told their audience there is a decrease in interim dividends. Biggest surprise here is HKG:0388 HKEx. This is also a Dividend Growth Challenger (streak of at least 5 years of dividend raises). Depending on the dividends of the end of the year results, we might have to take them off the list of all Dividend Growth stocks.

Here are the top 3 that lost the most in price (comparison of price at January 1, to June 30, 2022):

| Ticker | Company | Sector | Compared to January 1: |

| HKG:6098 | CG Services | Property Management & Agency | -65.38% |

| HKG:2007 | Country Garden | Property Development | -65.17% |

| HKG:2382 | Sunny Optical | Industrial Goods | -60.30% |

Then the 3 companies that saw their stock prices rise the most in the first 6 months of 2022

| Ticker | Company | Sector | Compared to January 1: |

| HKG:0883 | CNOOC | Petroleum & Gases | 27.02% |

| HKG:0688 | China Overseas | Property Development | 21.89% |

| HKG:0288 | WH Group | Agricultural, Poultry & Fishing production | 9.41% |

- Average difference in stock price (Jan 1 – June 1) of all Hong Kong Blue Chips is -16%.

- Average yield is 4%.

And lastly, one more interesting metric: EPS growth % over 12 months. (July 1 2021- June 30, 2022)

| Ticker | Company | Sector | EPS Growth % |

| HKG:1211 | BYD Company | Automobiles & Components | 194.49 |

| HKG:0883 | CNOOC | Petroleum & Gases | 103.83 |

| HKG:0066 | MTR | Public Transport | 76.74 |

| HKG:1113 | CH Assets | Property Investment | 57.78 |

| HKG:0857 | PetroChina | Petroleum & Gases | 51.10 |

| HKG:1038 | CKI Holdings | Conglomerate | 45.83 |

And that is it, a short summary of the 2022 Interim Results Hong Kong Blue Chip Stocks.

Sign up below (FREE) to download the file with all Hong Kong constituents.

Champion members: on your member page there is Data Set #4 with all details on these interim results.

To become a Champion member and get all data on Hong Kong Dividend growth and Blue Chip stocks, click here

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.