My Courses

-

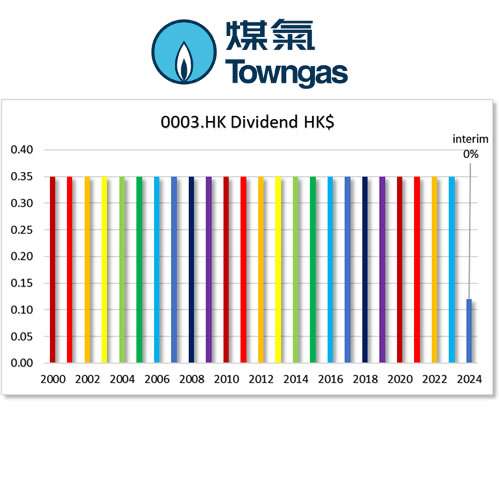

HKG:0003 HK & China Gas

HKG:0003 HK & China Gas Definitely the most boring stock on the HK stockmarket. This company has consistently paid dividends for 32 years, since 1992, at a fixed rate of HKD 0.35, but there has been no increase in the dividend amount. Moreover, the company has undergone several stock splits, almost every year.

-

Upcoming Ex-Dividend dates in Hong Kong

Upcoming Ex-Dividend dates in Hong Kong for Dividend Growth stocks. What does Ex Dividend mean? In the stock market, when a company decides to pay out dividends to its shareholders (like sharing profits), they set an Ex-Dividend Date. If you own the stock before this date, you get to receive the dividend…

-

Top 10 High yield Dividend Stocks

You found it: The Top 10 High yield Dividend Stocks. These are companies that have an dividend growth streak of at least 5 years. From all the Hong Kong stocks that comply to that criteria this is the top 10 selection that holds the highest yield. You want more? Just sign up (free) and get…

-

C-Trip HKG:9961 – Hong Kong Blue Chip stock

Blue Chip Stock C-Trip HKG:9961 0 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 24.89 Price-to-Book ratio : 2.58 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 22.3 BETA: 1.23 A Beta greater than 1.0 might indicate that the stock is more volatile than the…

-

NTES-S HKG:9999 – Hong Kong Blue Chip stock

Blue Chip Stock NTES-S HKG:9999 0 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 15.67 Price-to-Book ratio : 3.23 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 9.12 BETA: 0.99 A Beta greater than 1.0 might indicate that the stock is more volatile than the…

-

Alibaba HKG:9988 – Hong Kong Blue Chip stock

Blue Chip Stock Alibaba HKG:9988 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 17.04 Price-to-Book ratio : 1.46 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 4.7 BETA: 1.33 A Beta greater than 1.0 might indicate that the stock is more volatile than the market.…

-

New Oriental HKG:9901 – Hong Kong Blue Chip stock

Blue Chip Stock New Oriental HKG:9901 0 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 32.47 Price-to-Book ratio : 2.50 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 1.44 BETA: 1.18 A Beta greater than 1.0 might indicate that the stock is more volatile than…

-

Wuxi AppTech HKG:2359 – Hong Kong Blue Chip stock

Blue Chip Stock Wuxi AppTech HKG:2359 WuXi AppTec is a company that helps other companies in the healthcare industry, mainly pharmaceutical and medical device companies, bring new drugs and treatments to market faster and more cheaply. Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 16.40 Price-to-Book ratio : 2.70 preferably <1…

-

Haier SmartHome HKG:6690 – Hong Kong Blue Chip stock

Blue Chip Stock Haier SmartHome HKG:6690 0 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 12.82 Price-to-Book ratio : 2.19 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 2.09 BETA: 1.03 A Beta greater than 1.0 might indicate that the stock is more volatile than…

-

JD Health HKG:6618 – Hong Kong Blue Chip stock

Blue Chip Stock JD Health HKG:6618 0 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 31.69 Price-to-Book ratio : 1.61 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 0.89 BETA: 1.69 A Beta greater than 1.0 might indicate that the stock is more volatile than…