My Courses

-

HKG:0212 NanYang Holding

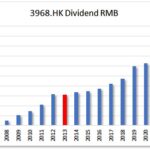

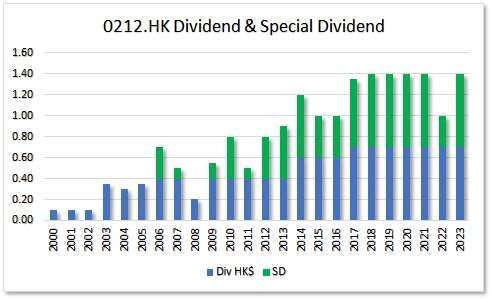

HKG:0212 NanYang Holding The Group is engaged in property investment and investment holding and trading. NanYang Holding (HK0212.HK) A dividend Contender. Although the dividend growth is not on a year on year base, the has not been a dividend decrease since 2008.

-

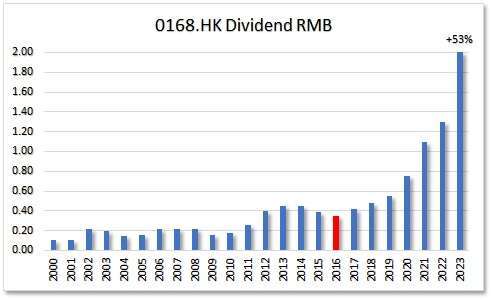

HKG:0168 TsingTao Brew

HKG:0168 TsingTao Brew Beer, the most famous beer in China probably. Dividend 2022 also came with a special dividend of RMB 0.50. (not on the chart ) EPS growth for 5 years in a row. Beer seems covid proof if we look at the results of this company.

-

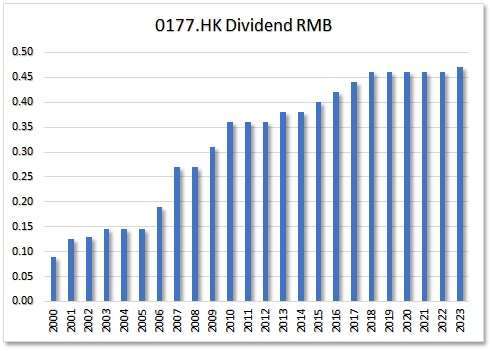

HKG:0177 Jiangsu Expressway

HKG:0177 Jiangsu Expressway This company did never ever lower their dividends. For 22 years! And you average dividend growth is not ashtonoshing, but the yield is!

-

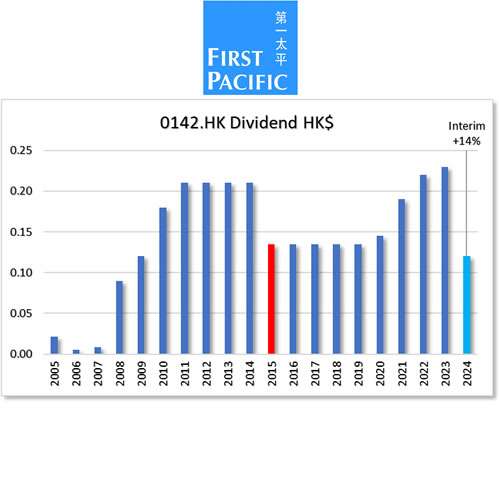

HKG:0142 First Pacific Co. Ltd.

HKG:0142 First Pacific Co. Ltd. The Company’s principal investments are in consumer food products, telecommunications, infrastructure, and natural resources.

-

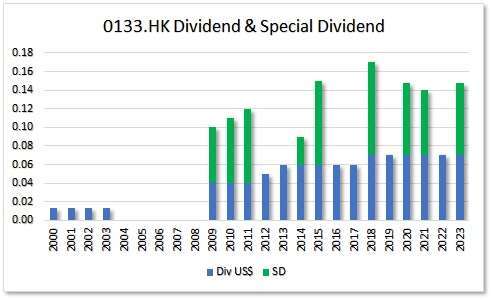

HKG:0133 China Merchants

HKG:0133 China Merchants China Merchants HKG:0133 has a good yield, pay out ration and dividend coverage ratio! EPS growth is up and down.

-

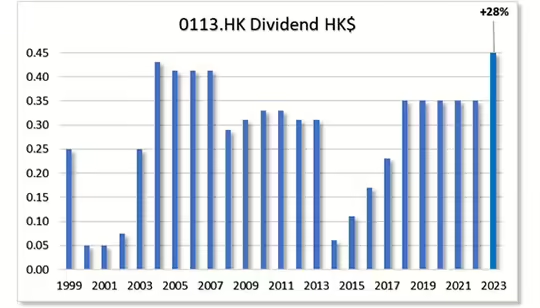

HKG:0113 Dickson Concept

HKG:0113 Dickson Concept The principal activities of the Group are the Sale of Luxury Goods and Securities Investment. Dickson Concepts (0113.HK) has held the distributorship of Ralph Lauren products in Asia for more than 20 years. Other brands the company holds are: TOMMY HILFIGER, Christofle, BERTOLUCCI and CHARLES JOURDAN.

-

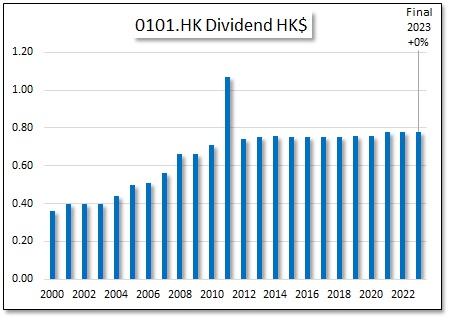

HKG:0101 Hang Lung Properties

HKG:0101 Hang Lung Properties Hang Lung Properties Ltd (0101.HK) is an investment holding company mainly engaged in property leasing. The enterprise operates its business through two segments. The Property Leasing segment is engaged in the leasing of portfolio of properties carrying the ’66’ brand in Mainland China, including Shanghai, Shenyang, Jinan, Wuxi, Tianjin, Dalian, Kunming,…

-

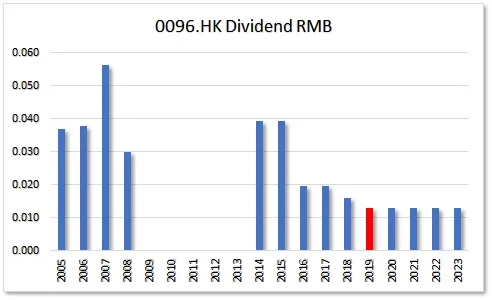

HKG:0096 Yusei

HKG:0096 Yusei The principal activities of the Group are moulding fabrication, manufacturing and trading of moulds and plastic components.

-

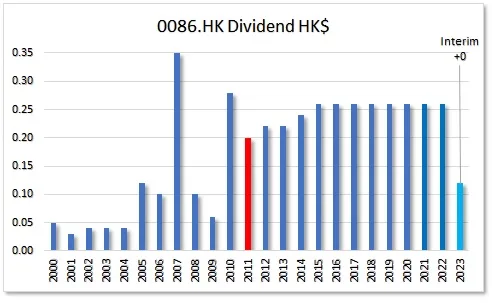

HKG:0086 Sun Hung Kai & Co. Ltd.

HKG:0086 Sun Hung Kai & Co. Ltd. Sun Hung Kai (0086.HK) had a bumpy dividend road to begin with. It appears the growth is solid now. Some figures make this an attractive dividend growth stock.

-

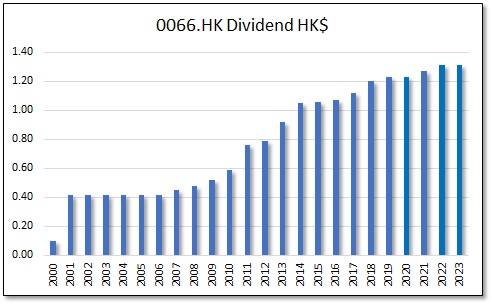

HKG:0066 MTR CORPORATION

HKG:0066 MTR CORPORATION Look at the beautiful chart. If you are into dividend growth investing, this is what you wish to see. This is a company everybody knows in Hong Kong. MTR Corporation 0066.HK is on the HK exchange since 2000. So far never a dividend decrease.