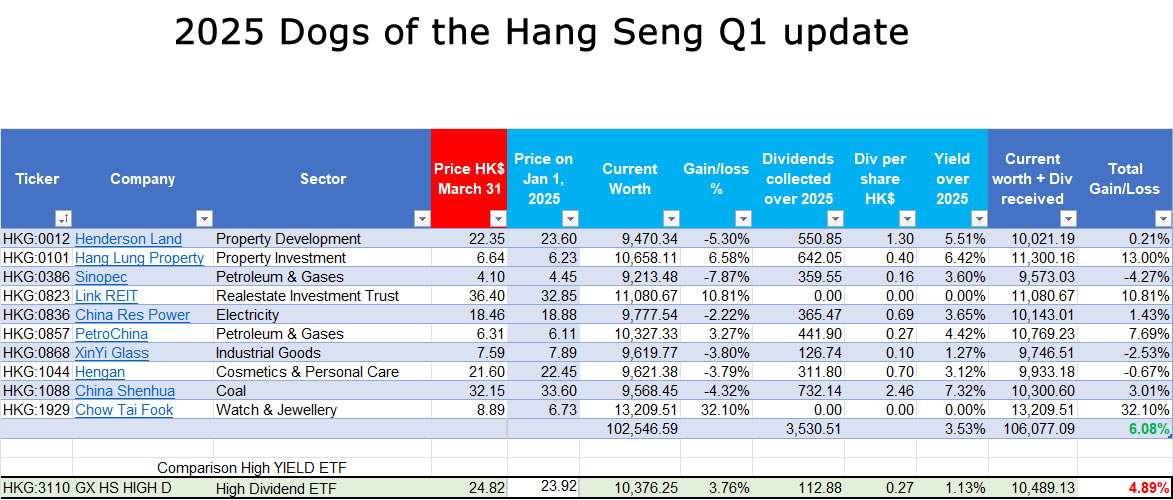

Results: the 2025 Dogs of the Hang Seng Q1

The first 3 months of 2025 are in the past. Time to look at our portfolio of the 2025 Dogs of the Hang Seng Q1

What are the Dogs of the Hang Seng?

- on January 1 we look at the list of Blue Chips

- take the top 10 that have the highest yield over the last year.

- we buy worth of HK$ 10.000 of each stock, total HK$ 100.000

- we wait and wait until December 31 and sell the complete portfolio

- January 1, we take the list of Blue Chips.. repeat.

And now we take a look at where this portfolio is taking us. For good measure, we also look at HKG:3110 Global X Hang Seng High Dividend Yield ETF

###Do not take this as financial advise or any other kind.

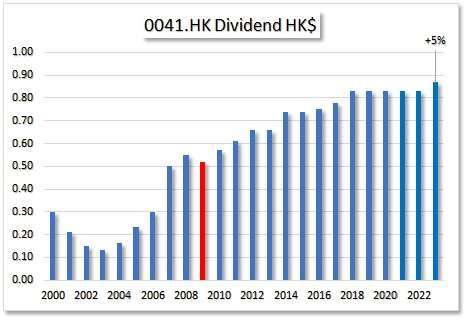

Find Out which of the Hong Kong Stocks Have Dividend Growth Potential—Skip Hours of Research |

Q1 Results: 2025 Dogs of the Hang Seng – The Good, The Bad & The Ugly

The Good:

So far, our hypothetical Dogs of the Hang Seng portfolio has generated

HK$3,530 in dividends, delivering a 3% yield. On top of that, the total return (including dividends) is up

6%. A solid start to the year for anyone who loves passive income.

The Bad:

When we compare the performance to the HKG:3110 High Dividend ETF, that ETF gained nearly

5% in total return. Not bad either—but the Dogs still came out ahead in Q1.

So yes, it’s close—but the Dogs barked louder this round.

The Ugly:

Here’s where it gets interesting. The Hang Seng Index surged

15.25% in Q1. Yet, this strong rally isn’t reflected in either the Dogs portfolio or the High Dividend ETF.

It reminds us that chasing high yield doesn’t always track the broader market gains—something to keep in mind

when designing a dividend-focused strategy.

Final Thought:

That wraps up Q1 for the 2025 Dogs of the Hang Seng. Let’s see who’s still wagging their tails when we check back in at the end of Q2.

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.