Top 10 High yield Dividend Stocks

Top 10 High-Yield Dividend Growth Stocks in Hong Kong

High dividend yields can be attractive, but they don’t always tell the full story. While some stocks offer steady, growing payouts, others might have unsustainable dividends due to financial trouble. This list highlights the 10 highest-yielding dividend growth stocks in Hong Kong—but keep in mind, high yield alone isn’t enough.

For investors who want a complete picture of a company’s dividend strength, it’s important to look beyond yield and assess:

✔ Dividend Growth – Is the company increasing its payouts over time?

✔ Dividend Safety – Can it continue paying dividends in all market conditions?

✔ Stock Valuation – Is the stock attractively priced, or is it a risk?

If you want to make informed investment decisions, signing up for free below or becoming a Champion Member will give you a deeper view of every Hong Kong dividend growth stock—not just the highest yielders.

Why Invest in Hong Kong Dividend Growth Stocks?

Hong Kong is an international financial hub with a strong economy and business-friendly tax policies. Unlike some markets, there is no dividend withholding tax, making it highly attractive for investors looking to maximize their passive income.

Key Benefits of Hong Kong Dividend Stocks:

✔️ Higher Yields than U.S. and European markets

✔️ No Dividend Tax – Keep 100% of your payouts

✔️ Exposure to Asia’s Growth – Invest in major players across finance, real estate, and utilities

By focusing on companies that grow their dividends consistently, you not only earn regular income but also protect your wealth from inflation.

To get this in an Excel list, just sign up below and you even get 25 highest yield dividend growth stocks immediately. (Yes, for free)

Note: This list is updated regularly based on our dividend growth analysis. Want full access to detailed insights? Become a Champion Member get full access and explore exclusive stock research!

| Tickers | Name | Sector | Yield |

| HKG:0327 | Pax Global | E-Commerce and Internet Services | 11.50% |

| HKG:0382 | Edvantage | Education | 10.91% |

| HKG:0659 | CTF Services | Heavy Industrial Machinery | 9.48% |

| HKG:0086 | Sun Hung Kai & Co. Ltd. | Other financials | 9.12% |

| HKG:3360 | FE Horizon | Other financials | 8.97% |

| HKG:0012 | HENDERSON LAND | Property Development | 8.96% |

| HKG:0101 | Hang Lung Properties | Property investment | 8.81% |

| HKG:1883 | CITIC TELECOM | Telecom Services | 8.55% |

| HKG:0331 | FSE Services | Conglomerate | 8.53% |

| HKG:0450 | Hung Hing Printing Group | Printing, Publishing & Packaging | 8.51% |

How to get the full picture

To make smarter investment choices, we use a three-pillar approach to evaluate dividend stocks:

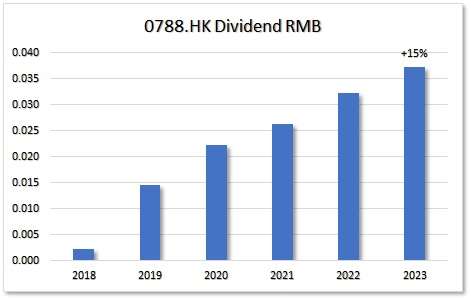

1 Dividend Growth – Does the company have a history of increasing payouts?

- Growing dividends signal financial strength.

- We focus on companies with a consistent track record of increases.

2- Dividend Safety – Can the company continue paying dividends?

- Payout ratio, earnings stability, and debt levels matter.

- Stocks with high yields but weak fundamentals may cut their dividends.

3- Stock Valuation – Is the stock a good deal?

- A high yield doesn’t mean a stock is cheap—it could mean trouble.

- We compare valuation metrics to avoid overpriced or risky stocks.

Final Thoughts: Don’t invest blindly

This list highlights the highest-yielding dividend growth stocks in Hong Kong, but yield alone doesn’t tell the full story. Some of these stocks will be excellent long-term investments, while others may be dividend traps.

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.