Understanding Dividend Payout Ratio

Understanding dividend payout ratio: A key to sustainable dividend growth

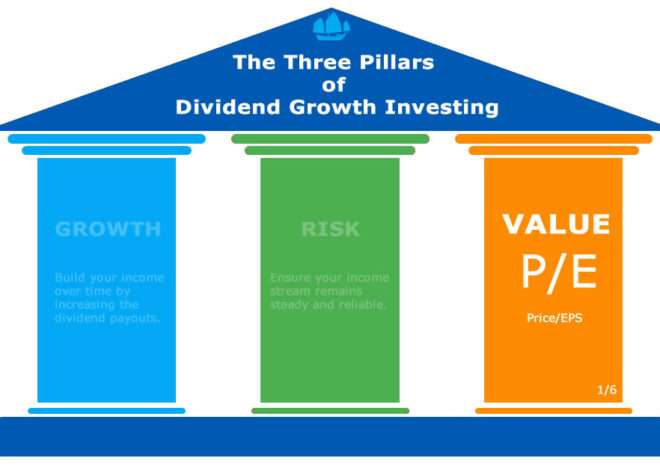

The dividend payout ratio is one of the most important metrics for dividend investors. It helps determine whether a company’s dividend payments are sustainable or at Risk of being cut.

At HongKongDividendStocks.com, we focus on stocks with payout ratios below 50%—a level that ensures dividends are well-covered by earnings and have room to grow.

What is the Dividend Payout Ratio? And what is a good payout ratio for dividends?

The dividend payout ratio measures the percentage of a company’s earnings that is paid out as dividends. It can be calculated in two ways:

Formula 1:

Dividend Payout Ratio = (Dividends Paid / Net Income) × 100

Formula 2:

Dividend Payout Ratio = (Dividend Per Share (DPS) / Earnings Per Share (EPS)) × 100

A lower payout ratio suggests the company retains enough earnings to reinvest and sustain its dividend over the long term.

The bubble tea stand example

Scenario 1: A healthy payout ratio

- Your bubble tea stand earns $100 in profit.

- You pay yourself $40 as a dividend.

- Your dividend payout ratio is:

(40 / 100) × 100 = 40%

This is sustainable because you are growing your business while paying yourself a reasonable dividend.

Scenario 2: A high payout ratio (Risky)

- Your bubble tea stand earns $100 in profit.

- You pay yourself $90 as a dividend.

- Your dividend payout ratio is:

(90 / 100) × 100 = 90%

This is risky because there’s little room for reinvestment.

Scenario 3: A negative payout ratio (Dangerous)

- Your bubble tea stand loses $50 this month (negative net income).

- You still pay yourself $20 as a dividend.

- Your dividend payout ratio is:

(20 / -50) × 100 = -40%

A negative payout ratio means dividends are being paid despite losses, which is not sustainable.

What payout ratio should you look for?

- Below 50%: Ideal. Leaves room for growth.

- 50%-70%: Acceptable but requires monitoring.

- Above 80%: Risky. Leaves little room for reinvestment.

- Negative: A red flag—dividends are being paid despite losses.

How We Use This at HongKongDividendStocks.com

Our stock screener likes companies with payout ratios below 50% to avoid dividend cuts.

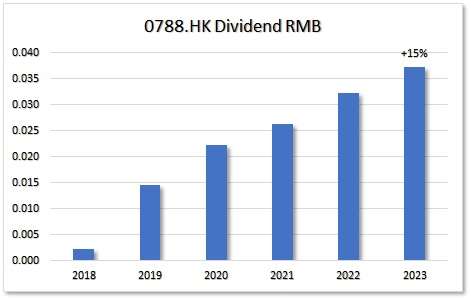

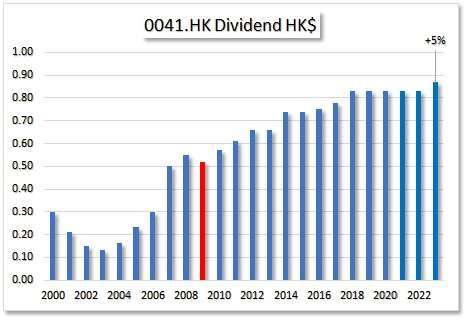

Companies with a low payout ratio and consistent dividend growth are more likely to increase dividends over time—which is exactly what dividend growth investors want.

Final Thoughts

The dividend payout ratio is a simple yet powerful tool to gauge a company’s financial health and dividend sustainability.

Would you invest in a lemonade stand that keeps losing money but still pays dividends? Probably not. The same logic applies to dividend stocks.

If you’re serious about building a sustainable dividend income, focus on companies with strong earnings, low payout ratios, and a history of dividend growth.

Want a shortcut? Our Champion members get access to a curated list of Hong Kong dividend growth stocks—already screened using the dividend payout ratio and other key metrics.

Start building your dividend growth portfolio today.

#DividendInvesting #PassiveIncome #FinancialFreedom #DividendGrowth #HongKongStocks

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.