What is dividend yield?

What is dividend yield and how is it calculated?

Investing can be an exciting and rewarding venture, especially when it comes to understanding concepts like yield. In this post we will explore:

- what dividend yield is,

- how to calculate yield, and

- what an average good yield could be in 2023.

1-What is dividend yield:

Yield, in the context of investing, refers to the return or profit generated from an investment over a specific period of time. It represents the income or percentage of return an investor receives on their investment. Yield is particularly important for income-focused investors who seek regular returns on their investments.

The formula goes like this: divide the annual dividends paid per share by the price per share.

Types of Yield: There are various types of yield, but the two most common ones are dividend yield and bond yield.

- Dividend Yield: Dividend yield is what we look at mostly on Hong Kong Dividend Stocks. Is a measure used for stocks, especially those of companies that pay regular dividends. You can calculate by dividing the annual dividend per share by the stock price, with the result expressed as a percentage. For example, if a stock pays an annual dividend of $2 per share and the current stock price is $40, the dividend yield would be 5%.

- Bond Yield: Bond yield refers to the interest or income earned from bonds. You can calculate by dividing the annual interest payment by the bond’s current market price. For example, if a bond pays an annual interest of $50 and the bond’s current market price is $1,000, the bond yield would be 5%.

2-How to calculate yield:

The formula to calculate yield depends on the type of investment. As mentioned earlier, dividend yield is calculated by dividing the annual dividend per share by the stock price. Bond yield, on the other hand, you can calculate by dividing the annual interest payment by the bond’s current market price.

3-What is an Average Good Yield in 2023:

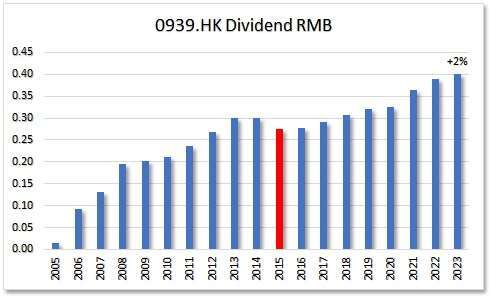

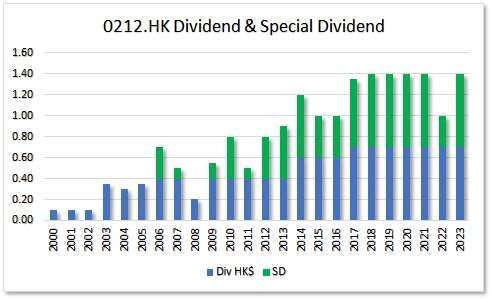

It is important to note that predicting future yields can be challenging as they are influenced by various factors such as economic conditions, market trends, and interest rates. While it is not possible to provide an exact average good yield for 2023, historical data and expert projections can offer insights. This is why we look at the metrics of dividend growth, the risk of dividend cuts and the value of a stock.

Historically, average good yields have varied across different investment types. For stocks, a dividend yield between 2% and 4% is often considered reasonable. However, this can be higher for certain industries or companies with strong dividend track records. Fact: Hong Kong dividend growth stocks have an average yield over 5%.

When it comes to bonds, a good yield in 2023 can depend on the prevailing interest rates at that time. Currently, interest rates are relatively low, which has led to lower bond yields. However, if interest rates rise in the future, bond yields may also increase. Experts predict that in the current low-interest-rate environment, a good bond yield could range between 2% and 4%.

Conclusion:

Understanding yield is crucial for investors as it helps evaluate the potential returns of an investment. Whether it’s dividend yield for stocks or bond yield for bonds, yield provides a measure of income or return. While there is no definitive answer to what an average good yield will be in 2023, it is important to consider historical data, market trends, and economic conditions when assessing potential investment opportunities. As you continue to explore the world of investing, remember that knowledge and research are key to making informed investment decisions.

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.