What is the P/E Ratio? And why is it important?

Why the P/E ratio is your first go-to at a stock’s true Value

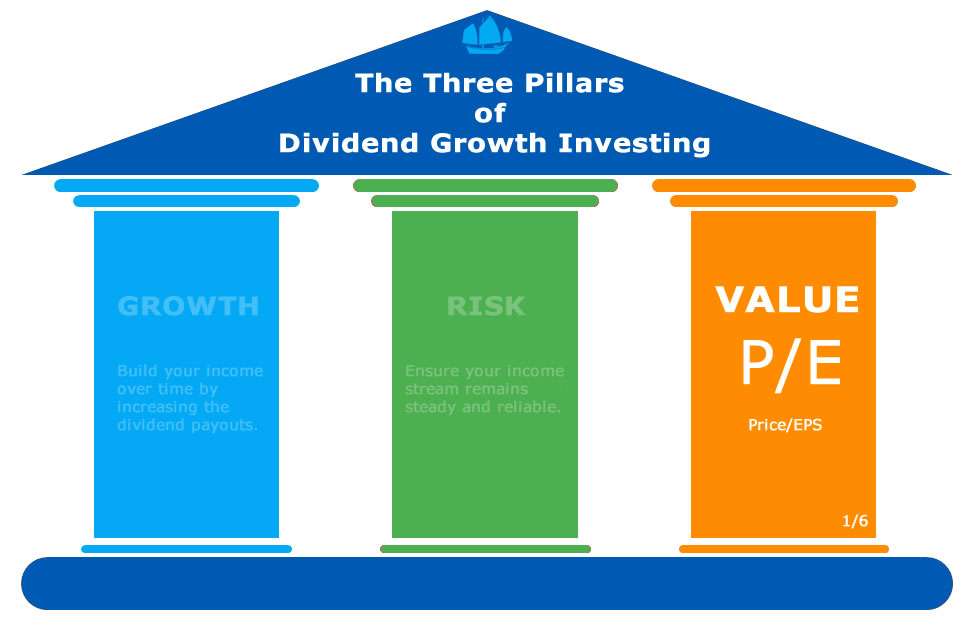

Investing in dividend growth stocks isn’t just about picking the companies with the highest yield. It’s about building a portfolio that grows your income, protects your capital, and maximizes long-term value. That’s why the three pillars—Dividend Growth, Risk, and Value—are the foundation of smart investing.

Among these, Value is your beacon when making decisions. Even the strongest dividend stocks can be bad investments if bought at the wrong price. This is where the Price-to-Earnings (P/E) ratio comes in. It’s one of the quickest and most powerful tools to determine whether a stock is reasonably priced or a potential trap.

The role of value in dividend growth investing

Value investing isn’t just about buying stocks at a discount. It’s about paying a fair price for a great business. A stock with strong dividend growth and low risk is ideal, but if you overpay, your returns shrink.

A company might increase its dividends consistently, but if its stock price is inflated beyond its actual worth, you risk years of under-performance. That’s why Value acts as your guardrail—helping you avoid overpriced stocks and find those that offer true long-term potential.

This is where the P/E ratio comes into play. It’s the first checkpoint in assessing value, giving you an instant sense of whether a stock is fairly priced.

What is the P/E Ratio?

The Price-to-Earnings (P/E) ratio measures how much investors are willing to pay for each dollar a company earns. The formula is simple:

P/E=Stock Price/Earnings Per Share (EPS)

A lower P/E means investors are paying less for a company’s earnings, which often signals better value. A higher P/E suggests the stock is more expensive relative to its profits, meaning expectations for future growth are already priced in.

But P/E isn’t just about numbers—it’s about what those numbers tell you about a stock’s true worth.

Why P/E Matters in Dividend Growth Investing

1. Helps you avoid overpaying for a stock

A dividend stock might have a strong yield, but if it has a P/E of 50 or more, you’re paying a premium. That stock would need enormous earnings growth to justify its price. If growth slows, the stock price can drop—leaving you with a poor return even if dividends keep coming in.

A P/E of 20 or lower is generally considered a good value in most markets. It means you’re not overpaying and have room for upside.

2. Gives Insight Into Market Expectations

A high P/E doesn’t always mean a stock is bad—it often signals growth expectations. But the question is: Are those expectations realistic?

For example, a stock with a P/E of 10 might look cheap, but if its earnings are declining, the market is pricing in trouble ahead. Likewise, a stock with a P/E of 30 might seem expensive, but if its earnings are growing rapidly, the valuation could still be reasonable.

This is why P/E should always be the first step, not the only step.

3. What is a good PE ratio?

For dividend growth investors, a low but stable P/E often signals strong earnings and therefor dividend safety. If a company has a P/E of 15 and a payout ratio below 50%, it’s likely reinvesting earnings into future growth while maintaining stable dividends.

But a stock with a P/E of 40 and a high payout ratio may struggle to sustain its dividend if earnings dip. High valuations often come with higher risk, especially if a company is using debt to fuel growth.

Using P/E in the Three-Pillar Framework

The Blueprint focuses on three key pillars:

- Dividend Growth – Ensuring your income grows over time.

- Risk of Dividend Cuts – Avoiding companies that could slash payouts.

- Value of the Stock – Making sure you’re paying the right price.

P/E plays a role in Value evaluating. It helps identify affordable stocks with sustainable dividends, while also flagging risky overvaluations that could lead to cuts or losses.

The right way to use P/E

- Compare P/E to the industry average – A stock with a P/E of 18 might seem high, but if competitors trade at 25, it could still be undervalued.

- Look at P/E in historical context – If a stock’s average P/E over five years is 12 but suddenly jumps to 30, ask why. Is the market overreacting, or is there real growth potential?

- Check dividend yield and payout ratios alongside P/E – A low P/E with a stable dividend and low payout ratio is a strong combination.

Conclusion: P/E is your first glance, not your final answer

P/E is a powerful tool, but it’s just the beginning. It helps filter out overpriced stocks and find better entry points, but it should always be used alongside other metrics like earnings growth, payout ratios, and debt levels.

By focusing on Value first, you ensure your dividend portfolio isn’t just growing, but also built on a solid foundation of smart investing decisions. The next time you look at a dividend stock, start with P/E under 20—but don’t stop there. Let it guide you deeper into finding the right stocks for long-term success.

As we’re wrapping up this post, here are the 10 key questions on P/E that will interest you.

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.