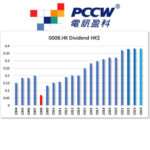

Why Dividend Growth Stocks Are a Smart Play in This Bull Rally

Right now, we’re in the middle of an exciting time in the stock market. Especially when it comes to Hong Kong stocks, things are really heating up. There’s a buzz, a sense that now is the time to invest. But how do you make sure you’re building a portfolio that will not only thrive in this bull rally but stand strong in the long run?

That’s where dividend growth stocks come in. These stocks not only pay dividends consistently but also increase those payouts over time. Here’s why focusing on dividend growth stocks in this market rally is a winning choice to build a strong, resilient portfolio.

1- A Reliable Source of Income

Dividend growth stocks offer something that many other investments don’t—predictable income. While the market can swing up and down, companies that grow their dividends year after year give you something you can count on.

Even when stock prices fluctuate, the regular income from dividends provides a cushion. It’s like a safety net that softens the blow when the market turns against you. This is important because in any rally, there will be corrections. Having that income rolling in regardless of stock price movements is a powerful benefit.

Find Out which of the Hong Kong Stocks Have Dividend Growth Potential—Skip Hours of Research |

2- Compounding Gains Over Time

What makes dividend growth stocks even more attractive is the potential for **compounding**. Reinvesting your dividends to buy more shares means you are growing your stake in the company. Over time, this reinvestment grows your portfolio in a way that’s much more significant than just holding on to stocks that don’t pay dividends.

With every dividend reinvested, your next dividend is larger because it’s based on a bigger number of shares. This creates a snowball effect that builds wealth steadily over time. In a bull market, this compounding effect is even stronger because your reinvested dividends are being used to buy shares that are also increasing in value.

3- A Hedge Against Inflation

Inflation erodes the purchasing power of your money. But companies that grow their dividends help fight back against inflation. Why? Because as a company’s revenue and profits increase, they pass some of that growth to shareholders through increased dividend payments.

When you hold dividend growth stocks, you are getting a rising income over time, which helps to counterbalance the effect of rising prices in the economy. While other assets might struggle to keep up with inflation, dividend growth stocks can help you maintain and even grow your purchasing power.

4- Less Volatility in a Bull Market

Bull markets are exciting. Everyone wants in on the action. But even in a rally, stock prices can be volatile. That’s where dividend growth stocks stand out. Historically, stocks that pay and grow their dividends are less volatile than those that don’t.

This is because investors tend to hold onto dividend-paying stocks for longer. They know they’re getting a return through dividends even if the stock price wobbles in the short term. This stability can provide peace of mind, allowing you to stay invested during the highs and lows of the market without the stress that comes with more speculative investments.

5- Proven Performers Over the Long Term

The companies that are able to increase their dividends consistently over time tend to be financially strong. They are often leaders in their industries, with solid cash flows and business models that allow them to grow regardless of the economic environment. These are the companies that have weathered many storms and come out stronger on the other side.

While some investors chase the hottest new stock or trend, the slow and steady approach of investing in dividend growth stocks has proven to be a winning strategy over the long term. Research shows that dividend-growing stocks outperform non-dividend-paying stocks over long periods.

The Current Bull Rally: Why Now?

This brings us back to the current bull market. Hong Kong’s stock market is booming, driven by a wave of optimism due to recent stimulus policies. Investors are pouring into the market, and it’s easy to get swept up in the excitement. But, remember, not all stocks are created equal.

Dividend growth stocks are your way to participate in the rally without taking on excessive risk. You get to enjoy the upside of a rising market while also receiving dividends that are growing over time. In fact, many institutional investors are turning back to Hong Kong’s dividend-paying stocks right now, seeing them as a safe way to gain exposure to the market rally without putting all their chips on the table.

Building a Strong, Balanced Portfolio

Investing in dividend growth stocks isn’t just about taking advantage of a bull rally. It’s about building a balanced, diversified portfolio, that can weather different market conditions. Dividend growth stocks provide both income and the potential for capital appreciation, making them a key part of any strong, long-term investment strategy.

If you’re looking for a way to capitalize on the current rally while building a portfolio that will last, dividend growth stocks are a great choice. They offer a unique combination of stability, income, and growth potential that can help you achieve your financial goals, whether the market continues its upward climb or takes a turn.

The Time Is Now

With Hong Kong stocks performing so well, there has never been a better time to start investing in dividend growth stocks. They provide a strong foundation for your portfolio, offering both the excitement of a bull market and the security of a steady income stream. Take advantage of the current market conditions and start building a future where your money works as hard as you do.

Invest smartly. Invest in dividend growth.

Sign up now and get immediate access to

25 highest yield dividend growth stocks.xls

The Best Part?

It’s completely free. No catch—just honest, data-driven insights that arm you with a consistent approach to dividend growth investing.