My Courses

-

HKG:1177 Sino Biopharm

HKG:1177 Sino Biopharm The Group’s business works in a fully integrated chain which spans from R&D to manufacture and sales of pharmaceutical products, covering a vast array of biopharmaceutical, chemical and modernized Chinese medicines. Interim result 2022 are favorable for dividends (+200%) yet EPS fell 77%

-

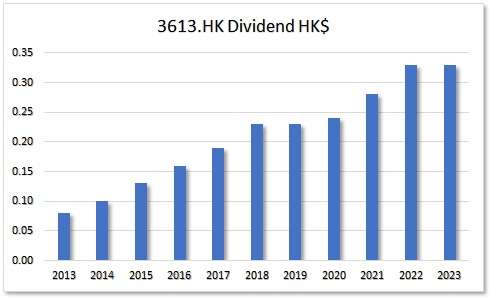

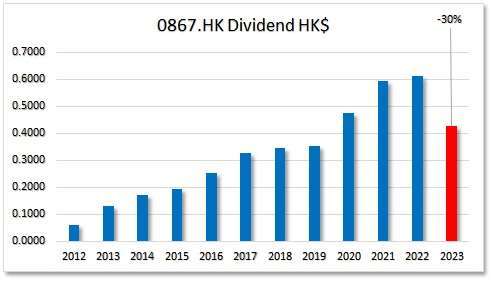

HKG:0867 CMS

HKG:0867 CMS What a beautiful chart! Results of 2022 are okay. Dividends got up 2.5% , Debt/Equity remained stable. This looks promising in terms of higher proceeds of holding this stock. (Average 5-yr Dividend Growth is almost 15%)

-

HKG:0855 CHINA WATER

HKG:0855 CHINA WATER China Water Affairs Group Ltd, 0855.HK formerly China Silver Dragon Group Ltd, is an investment holding company principally engaged in city water supply operation and construction. The Company operates its business through three segments. The City Water Supply Operation and Construction segment engages in the provision of water supply operation and construction…

-

HKG:0384 CHINA GAS HOLD

HKG:0384 CHINA GAS HOLD Glorious Dividend Contender: China Gas Holding (0384.HK) . Most Contenders/Achievers do not have a high dividend growth rate. This is an exception. Almost 17% average dividend growth over 5 years and about 8 years to get to 10% yield on costs.

-

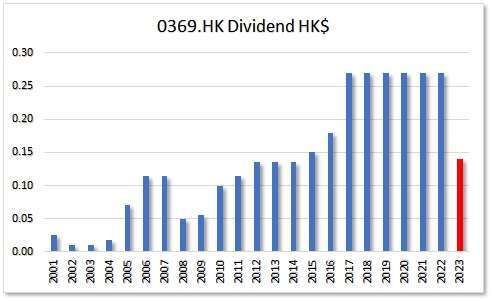

HKG:0369 WING TAI PPT

HKG:0369 WING TAI PPT Wing Tai Properties (0369.HK) is a Dividend Contender. The years that were skinny, they froze the dividend, never decreased in 13 years. The last couple of years the dividend growth stagnated to zero. A good high yield is making up for it. Also dividend p

-

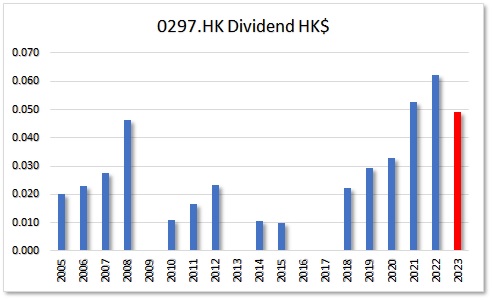

HKG:0297 Sinofert

HKG:0297 Sinofert 2023 New dividend challenger. Dividend growth is linked to EPS growth when we look at a five-year history. And it looks like s long as EPS keeps increasing, your dividend will also increase.

-

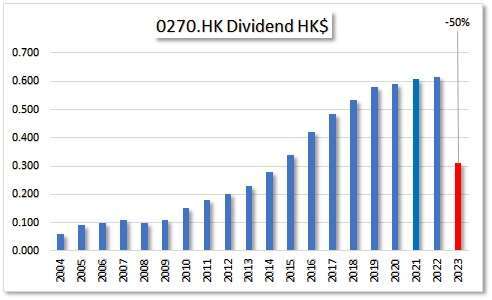

HKG:0270 GUANGDONG INV

HKG:0270 GUANGDONG INV The Group is principally engaged in water resources, property investment and development, department store operation, hotel ownership, operation and management and infrastructure (energy projects and road and bridge operation).

-

HKG:0222 Min Xin Holding

HKG:0222 Min Xin Holding Min Xin Holdings (0222.HK) a conglomerate involved in many businss endeavours. A brilliant payout ratio

-

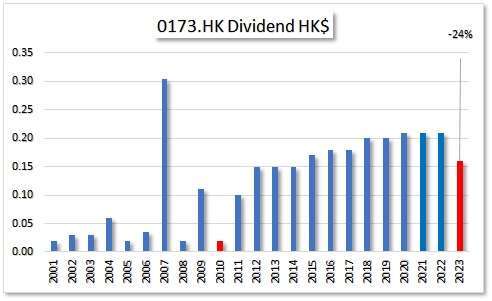

HKG:0173 K. WAH INT’L

HKG:0173 K. WAH INT’L This company has recently reduced its dividend payout. This follows a significant decline in earnings per share (EPS) over the past two years. The lower EPS resulted in an unsustainable payout ratio, necessitating a reduction in dividends to maintain fina

-

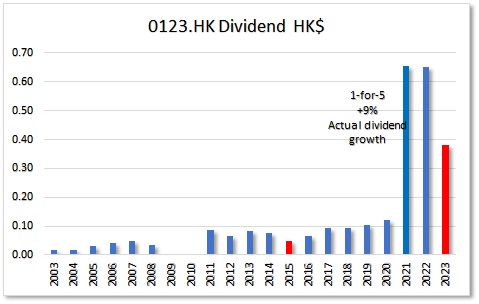

HKG:0123 Yuexiu Property Co. Ltd.

HKG:0123 Yuexiu Property Co. Ltd. The company became a Dividend Challenger in March 2021. In the Dividend chart you see the dividend growth consistency is a bit short of being actually consistent. The 5 year streak looks like a strike of 5 year luck. If we look at some numbers: P/E looks