My Courses

-

The top 10 Blue Chip stocks that are leading the bull-run

On Friday, Hong Kong’s stock market experienced a notable upward movement, with the benchmark Hang Seng Index rising by 3.55% to close at 20,632.3 points. This significant jump reflected a growing sense of optimism among investors in the region. As trading began, the Hang Seng Index surpassed the 20,000-point mark, demonstrating a strong start to…

-

CG Services HKG:6098 – Hong Kong Blue Chip stock

Blue Chip Stock CG Services HKG:6098 Country Garden Services Holdings Company Limited 6098.HK is a China-based provider of residential property management services. The Company mainly provides property management services, community value-added services and non-owner value-added services. Its value-added services include advisory services, as well as clean up, landscaping and maintenance services. The Company owns the…

-

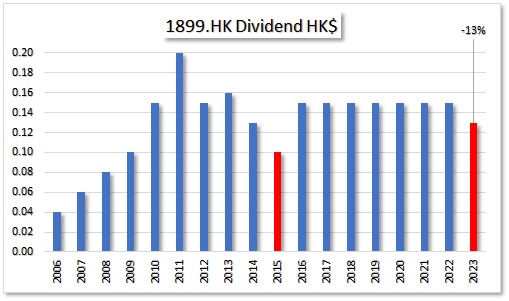

HKG:1899 XingDa Int’l

HKG:1899 XingDa Int’l Xingda International Holdings Limited (1899.HK) is an investment holding company principally engaged in the manufacture and trading of radial tire cords, bead wires and other wires. The radial tire cords are used for trucks and passenger cars. The Company operates its business mainly in China, India, Korea, United States of America and…

-

HKG:1686 Sunevision Holdings Ltd.

HKG:1686 Sunevision Holdings Ltd. For 3 years the dividend pyout ratio was close to 100%. 2023 that was ut short to 50%. Unfortunately that ended the beautiful chart of 11 consequtive dividend raises.

-

HKG:1177 Sino Biopharm

HKG:1177 Sino Biopharm The Group’s business works in a fully integrated chain which spans from R&D to manufacture and sales of pharmaceutical products, covering a vast array of biopharmaceutical, chemical and modernized Chinese medicines. Interim result 2022 are favorable for dividends (+200%) yet EPS fell 77%

-

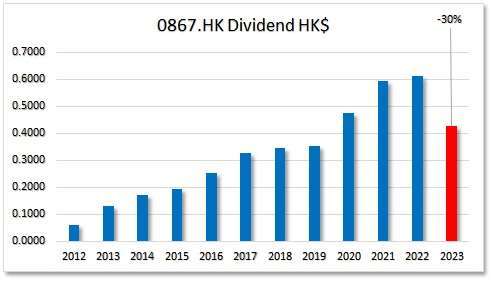

HKG:0867 CMS

HKG:0867 CMS What a beautiful chart! Results of 2022 are okay. Dividends got up 2.5% , Debt/Equity remained stable. This looks promising in terms of higher proceeds of holding this stock. (Average 5-yr Dividend Growth is almost 15%)

-

HKG:0855 CHINA WATER

HKG:0855 CHINA WATER China Water Affairs Group Ltd, 0855.HK formerly China Silver Dragon Group Ltd, is an investment holding company principally engaged in city water supply operation and construction. The Company operates its business through three segments. The City Water Supply Operation and Construction segment engages in the provision of water supply operation and construction…

-

HKG:0384 CHINA GAS HOLD

HKG:0384 CHINA GAS HOLD Glorious Dividend Contender: China Gas Holding (0384.HK) . Most Contenders/Achievers do not have a high dividend growth rate. This is an exception. Almost 17% average dividend growth over 5 years and about 8 years to get to 10% yield on costs.

-

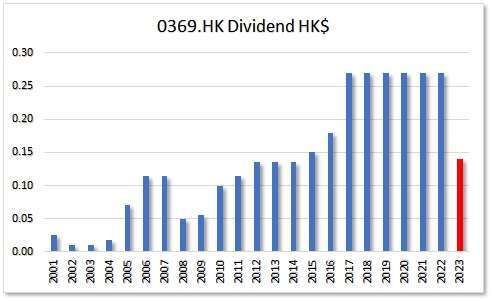

HKG:0369 WING TAI PPT

HKG:0369 WING TAI PPT Wing Tai Properties (0369.HK) is a Dividend Contender. The years that were skinny, they froze the dividend, never decreased in 13 years. The last couple of years the dividend growth stagnated to zero. A good high yield is making up for it. Also dividend p

-

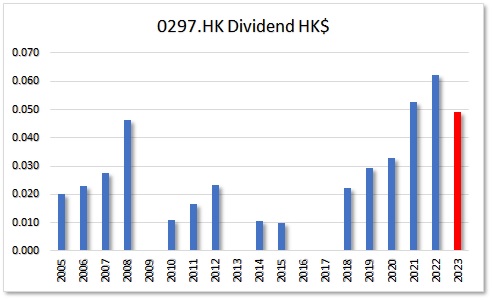

HKG:0297 Sinofert

HKG:0297 Sinofert 2023 New dividend challenger. Dividend growth is linked to EPS growth when we look at a five-year history. And it looks like s long as EPS keeps increasing, your dividend will also increase.