My Courses

-

Sunny Optical HKG:2382 – Hong Kong Blue Chip stock

Blue Chip Stock Sunny Optical HKG:2382 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 41.66 Price-to-Book ratio : 3.15 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 1.72 BETA: 1.23 A Beta greater than 1.0 might indicate that the stock is more volatile than the…

-

MengNiu Dairy HKG:2319 – Hong Kong Blue Chip stock

Blue Chip Stock MengNiu Dairy HKG:2319 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 15.22 Price-to-Book ratio : 1.45 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 1.16 BETA: 1.13 A Beta greater than 1.0 might indicate that the stock is more volatile than the…

-

PING AN HKG:2318 – Hong Kong Blue Chip stock

Blue Chip Stock PING AN HKG:2318 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 2.13 Price-to-Book ratio : 0.84 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 21.29 BETA: 1.47 A Beta greater than 1.0 might indicate that the stock is more volatile than the…

-

Li Auto HKG:2015 – Hong Kong Blue Chip stock

Blue Chip Stock Li Auto HKG:2015 The company’s main activities include designing, developing, manufacturing, and selling new energy vehicles, as well as offering additional sales and services in the People’s Republic of China. Updated: December 22, 2024 Ex Dividend: Never Quick glance, Price-to-earnings (P/E ratio): 18.07 Price-to-Book ratio : 2.60 preferably <1 although some value…

-

China Res Mixc HKG:1209 – Hong Kong Blue Chip stock

Blue Chip Stock China Res Mixc HKG:1209 0 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 20.09 Price-to-Book ratio : 3.58 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 1.41 BETA: 1.70 A Beta greater than 1.0 might indicate that the stock is more volatile…

-

SinoPharm HKG:1099 – Hong Kong Blue Chip stock

Blue Chip Stock SinoPharm HKG:1099 The company distributes medicine to hospitals, pharmacies, and clinics. They also run pharmacy stores, distribute medical devices and laboratory supplies, make chemical reagents, and sell pharmaceutical products. Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 7.20 Price-to-Book ratio : 0.84 preferably <1 although some value investors…

-

Chow Tai Fook HKG:1929 – Hong Kong Blue Chip stock

Blue Chip Stock Chow Tai Fook HKG:1929 This company dazzles in the world of luxury, crafting and selling stunning jewelry pieces—from gem-studded designs to platinum and K-gold creations. They also sparkle in gold jewelry and products, all while keeping time stylishly as distributors of various watch brands. Guess in which year this group started? Updated:…

-

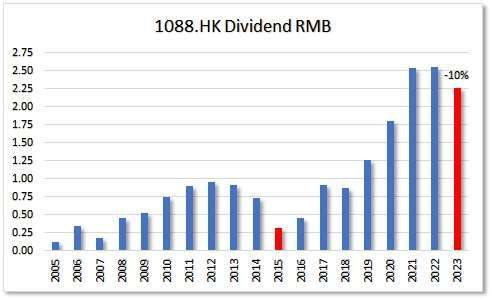

China Shenhua HKG:1088 – Hong Kong Blue Chip stock

Blue Chip Stock China Shenhua HKG:1088 China Shenhua is a globally-leading integrated coal-based energy company, mainly engaging in seven business segments, namely coal, electricity, new energy, coal-to-chemicals, railway, port handling, and shipping. Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 9.45 Price-to-Book ratio : 1.42 preferably <1 although some value investors…

-

Anta Sports HKG:2020 – Hong Kong Blue Chip stock

Blue Chip Stock Anta Sports HKG:2020 ANTA Sports Products Limited is principally engaged in the manufacture and trading of sporting goods, including footwear, apparel and accessories in the Mainland China. The Company focuses on sportswear market in China with a brand portfolio, including ANTA, ANTA KIDS, FILA, FILA KIDS and NBA. Through its subsidiaries, the…