My Courses

-

Budweiser APAC HKG:1876 – Hong Kong Blue Chip stock

Blue Chip Stock Budweiser APAC HKG:1876 Budweiser Brewing Company APAC Ltd 01876.HK is an investment holding company principally engaged in the brewing and distribution of beer. The Company produces, imports, markets, distributes and sells a portfolio of beer brands owned or licensed by the Company, including Budweiser, Stella Artois, Corona, Hoegaarden, Cass and Harbin. The…

-

BYD Company HKG:1211 – Hong Kong Blue Chip stock

Blue Chip Stock BYD Company HKG:1211 BYD Company 1211.HK is a China-based company mainly engaged in the production and sales of transportation equipment. The Company also produces and sells of electronic parts and components and electronic devices for daily use. The Company’s products include rechargeable batteries and photovoltaic products, mobile phone parts and assembly, and…

-

ShenZhou International HKG:2313 – Hong Kong Blue Chip stock

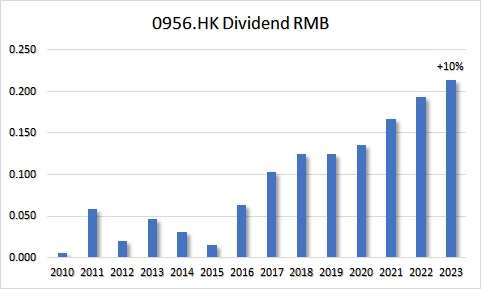

Blue Chip Stock ShenZhou International HKG:2313 Since the start this company did not lower it’s dividends. The Special Dividends are Not in the chart. Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 15.78 Price-to-Book ratio : 2.48 preferably <1 although some value investors like it till <3 Earnings per Share (EPS):…

-

WuXi Biologics HKG:2269 – Hong Kong Blue Chip stock

Blue Chip Stock WuXi Biologics HKG:2269 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 26.18 Price-to-Book ratio : 1.62 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 0.65 BETA: 1.58 A Beta greater than 1.0 might indicate that the stock is more volatile than the…

-

Sands HKG:1928 – Hong Kong Blue Chip stock

Blue Chip Stock Sands HKG:1928 The Group mostly runs casino games and builds special places in Macao. They also offer other helpful services there. Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 20.88 Price-to-Book ratio : 41.76 preferably <1 although some value investors like it till <3 Earnings per Share (EPS):…

-

XiaoMi HKG:1810 – Hong Kong Blue Chip stock

Blue Chip Stock XiaoMi HKG:1810 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 39.07 Price-to-Book ratio : 4.20 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 0.81 BETA: 1.02 A Beta greater than 1.0 might indicate that the stock is more volatile than the market.…

-

CH Assets HKG:1113 – Hong Kong Blue Chip stock

Blue Chip Stock CH Assets HKG:1113 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 6.92 Price-to-Book ratio : 0.27 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 4.41 BETA: 0.66 A Beta greater than 1.0 might indicate that the stock is more volatile than the…

-

China Resources HKG:1109 – Hong Kong Blue Chip stock

Blue Chip Stock China Resources HKG:1109 When a company announced its Dividends in RMB and Dividends are calculated in HK$, it can cause misunterstandings. In RMB there is still a slight Dividend increase for China Resources Land (HKG:1109) over 2019. Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 5.30 Price-to-Book ratio…

-

Wharf REIC HKG:1997 – Hong Kong Blue Chip stock

Blue Chip Stock Wharf REIC HKG:1997 0 Updated: December 22, 2024 Ex Dividend: N/A Quick glance, Price-to-earnings (P/E ratio): 12.42 Price-to-Book ratio : 0.32 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 1.57 BETA: 1.01 A Beta greater than 1.0 might indicate that the stock is more volatile than…

-

ICBC HKG:1398 – Hong Kong Blue Chip stock

Blue Chip Stock ICBC HKG:1398 Updated: December 22, 2024 Ex Dividend: 2-Jan Quick glance, Price-to-earnings (P/E ratio): 4.61 Price-to-Book ratio : 0.41 preferably <1 although some value investors like it till <3 Earnings per Share (EPS): 1.05 BETA: 0.47 A Beta greater than 1.0 might indicate that the stock is more volatile than the market.…